UBS Group AG Registered Ordinary Shares (UBS)

47.88

+0.31 (0.65%)

NYSE · Last Trade: Jan 13th, 3:21 AM EST

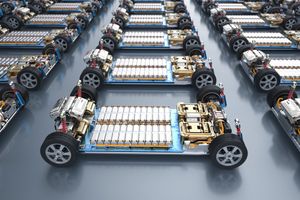

Is what's good for lithium prices good for all lithium producers -- or only Albemarle?

Via The Motley Fool · January 12, 2026

LONDON — In a move that has sent shockwaves through global commodity markets, HSBC has issued a landmark research note projecting that gold prices will soar to $5,000 per ounce by the second quarter of 2026. The banking giant, long considered a conservative voice in precious metals forecasting, cites a

Via MarketMinute · January 12, 2026

The global energy market experienced a sharp recalibration on January 12, 2026, as crude oil prices retreated from one-month highs. The pivot followed official statements from the Iranian government claiming that widespread civil unrest, which had gripped the nation for over two weeks, was now "under total control." This cooling

Via MarketMinute · January 12, 2026

Eli Lilly Stock Rises After Hours On UBS ‘Buy’ Call Ahead Of Oral Obesity Pill Launch — GLP-1 Battle With Novo Heats Upstocktwits.com

Via Stocktwits · January 6, 2026

The global financial landscape reached a fever pitch on January 12, 2026, as precious metals markets witnessed an unprecedented explosion in demand, sending gold and silver prices to heights once deemed unreachable. In a single day of frantic trading, gold breached the $4,600 per ounce psychological barrier, while silver

Via MarketMinute · January 12, 2026

The global financial landscape shifted violently on January 12, 2026, as silver prices breached the psychological and historic barrier of $85 per ounce. Driven by a volatile cocktail of escalating geopolitical conflict in the Middle East and a burgeoning institutional crisis within the United States, the "white metal" has transitioned

Via MarketMinute · January 12, 2026

As the "First Wave" of Artificial Intelligence infrastructure—dominated by raw compute and high-bandwidth memory—matures, the market is turning its attention to the "Second Wave": data gravity. At the heart of this shift is Pure Storage (NYSE: PSTG), a company that has evolved from a disruptive hardware startup into a software-defined storage powerhouse. As of January [...]

Via PredictStreet · January 2, 2026

The first trading week of 2026 has delivered a complex narrative for the technology sector, defined by a stark contrast between groundbreaking innovation and a massive institutional shift in capital. As the world gathered for the Consumer Electronics Show (CES) in Las Vegas, Nvidia Corp. (NASDAQ: NVDA) once again seized

Via MarketMinute · January 9, 2026

Emerson Electric is scheduled to release its fiscal first-quarter earnings soon, and analysts project a single-digit earnings growth.

Via Barchart.com · January 9, 2026

In a move that has further dampened investor sentiment, a top executive at The Campbell’s Company (NYSE:CPB) has offloaded a significant portion of his holdings just as the consumer staples giant closes out one of its most challenging years in recent history. Charles A. Brawley III, the company’

Via MarketMinute · January 9, 2026

The toy industry giant Mattel, Inc. (NASDAQ: MAT) found itself at the center of market volatility today, January 9, 2026, as the stock experienced a sharp reversal following a period of sustained momentum. After hitting a fresh 52-week high of $22.25 during yesterday’s session, the stock pivoted lower

Via MarketMinute · January 9, 2026

Shares of memory chips maker Micron (NYSE:MU)

jumped 4.5% in the morning session after a wave of positive developments, including a credit rating upgrade from Moody's and plans for a new $100 billion manufacturing plant in New York.

Via StockStory · January 9, 2026

Shares of composite decking and railing products manufacturer Trex Company (NYSE:TREX)

jumped 4% in the morning session after BMO Capital reiterated its Outperform rating on the stock.

Via StockStory · January 9, 2026

Alpha Metallurgical Resources produces metallurgical and thermal coal for industrial clients from operations in Virginia and West Virginia.

Via The Motley Fool · January 9, 2026

As gold prices shatter historical records, reaching a staggering $4,450 per ounce in early January 2026, Newmont Corporation (NYSE: NEM) has emerged as the primary beneficiary of a massive rotation by institutional investors. The world’s largest gold miner has seen its stock price surge by more than 130%

Via MarketMinute · January 9, 2026

LAS VEGAS — In a packed keynote at the 2026 Consumer Electronics Show (CES), Nvidia (NASDAQ: NVDA) CEO Jensen Huang officially unveiled the "Rubin" GPU architecture, the successor to the highly successful Blackwell series. Named after the pioneering astronomer Vera Rubin, the new platform promises a seismic shift in artificial intelligence

Via MarketMinute · January 8, 2026

Shares of fabless chip and software maker Broadcom (NASDAQ:AVGO)

fell 3.1% in the morning session after a broader market rotation out of the technology sector led to profit-taking following a recent rally.

Via StockStory · January 8, 2026

Shares of defense, intelligence, and IT solutions provider CACI International (NYSE:CACI)

jumped 2.6% in the morning session after a report from investment bank UBS highlighted the company as one of its top picks for 2026 in the U.S. aerospace and defense sector.

Via StockStory · January 8, 2026

In a move that has sent ripples through the retail sector, UBS Group AG (NYSE: UBS) has officially upgraded Gap Inc. (NYSE: GAP) from "Neutral" to "Buy," signaling a robust vote of confidence in the apparel giant’s multi-year turnaround strategy. The upgrade, issued on January 8, 2026, comes with

Via MarketMinute · January 8, 2026

January 8, 2026 — The silver market experienced a jarring reality check on Thursday as spot prices plummeted 5%, dragging major mining stocks down in a wave of technical selling. After a historic 2025 that saw the "poor man’s gold" gain over 150%, spot silver retreated to approximately $74.14

Via MarketMinute · January 8, 2026

iShares MSCI Europe Financials ETF provides sector exposure to developed European financials via a passive, index-based strategy.

Via The Motley Fool · January 7, 2026

Intel shares are garnering retail interest after its latest announcement in the ongoing CES event has given traders confidence that its manufacturing process around chipmaking can compete with its immediate rivals.

Via Stocktwits · January 7, 2026

United Rentals is all set to announce its fiscal fourth-quarter earnings soon, and analysts project a single-digit profit growth.

Via Barchart.com · January 7, 2026

Ethereum proof-of-concept transactions have been conducted by UBS, PostFinance, and Sygnum Bank previously.

Via Stocktwits · January 7, 2026

On January 6, 2026, UBS Group AG (NYSE:UBS) officially declared coupon payments for 12 of its ETRACS Exchange Traded Notes (ETNs), a move that underscores the bank's continued dominance in the high-yield, leveraged income space. The announcement, which covers a diverse array of assets including Master Limited Partnerships (MLPs)

Via MarketMinute · January 6, 2026