Lennar Corp (LEN)

116.12

-5.14 (-4.24%)

NYSE · Last Trade: Feb 19th, 4:58 PM EST

The U.S. economy displayed unexpected vigor this morning as the Department of Labor released the February 2026 employment figures, revealing that employers added 130,000 jobs last month. This figure dramatically outpaced the 75,000 positions anticipated by a consensus of Wall Street economists, signaling that the labor market

Via MarketMinute · February 19, 2026

The Federal Reserve has effectively tapped the brakes on market expectations for an early spring rate cut, according to the minutes from the January 27-28 Federal Open Market Committee (FOMC) meeting released on February 18, 2026. While the central bank acknowledged that headline inflation has receded to 2.4% as

Via MarketMinute · February 19, 2026

U.S. homebuilder Lennar Corp. disclosed a stake in Opendoor on Wednesday.

Via Stocktwits · February 19, 2026

NEW YORK, Feb. 18, 2026 — Building materials titan CRH Plc (NYSE: CRH) cemented its status as a cornerstone of the American industrial landscape today, reporting record-breaking financial results for the fiscal year 2025. The company announced a total revenue of $37.4 billion, a performance bolstered by a strategic pivot

Via MarketMinute · February 18, 2026

In a morning report that has sent a jolt of optimism through the financial markets, the U.S. Census Bureau and the Department of Housing and Urban Development revealed today, February 18, 2026, that the American housing sector is performing with unexpected vigor. Both Housing Starts and Building Permits for

Via MarketMinute · February 18, 2026

The U.S. bond market witnessed a sharp sell-off on February 18, 2026, as a "perfect storm" of stronger-than-expected economic data and lackluster demand for long-term government debt pushed Treasury yields to their highest levels in weeks. The benchmark 10-year Treasury yield climbed to 4.08%, while the policy-sensitive 2-year

Via MarketMinute · February 18, 2026

WASHINGTON, D.C. — In a powerful display of economic resilience that has caught Wall Street off guard, U.S. industrial production and manufacturing output surged in January 2026, significantly exceeding economist forecasts. Data released by the Federal Reserve on Wednesday, February 18, 2026, revealed that total industrial production rose by

Via MarketMinute · February 18, 2026

The Federal Reserve released the minutes from its January 27–28 policy meeting today, February 18, 2026, sending a clear message to Wall Street: the era of rapid rate cuts is on a definitive hiatus. Despite mounting political pressure and a cooling—but still resilient—labor market, the Federal Open

Via MarketMinute · February 18, 2026

The U.S. housing market faced a sobering reality check this week as the National Association of Home Builders (NAHB)/Wells Fargo (NYSE: WFC) Housing Market Index (HMI) slumped to a reading of 36 for February 2026. This unexpected decline, down from 37 in January, marks the 22nd consecutive month

Via MarketMinute · February 18, 2026

As of February 17, 2026, the U.S. housing market has reached a pivotal inflection point. Data from late 2025 confirms that all-cash home purchases have plummeted to their lowest level in five years, signaling a definitive retreat by institutional investors and a cooling of the hyper-competitive bidding wars that

Via MarketMinute · February 17, 2026

The S&P 500 (^GSPC) is often seen as a benchmark for strong businesses, but that doesn’t mean every stock is worth owning.

Some companies face significant challenges, whether it’s stagnating growth, heavy debt, or disruptive new competitors.

Via StockStory · February 16, 2026

In the upper echelons of the American homebuilding industry, NVR, Inc. (NYSE: NVR) has long been regarded as the gold standard of capital efficiency. However, the market’s reaction in mid-February 2026 has left even seasoned analysts scratching their heads. On February 11, 2026, NVR’s board approved a fresh $750 million share repurchase authorization—a move that [...]

Via Finterra · February 16, 2026

As the dust settles on the fourth-quarter 2025 earnings season, Martin Marietta Materials (NYSE: MLM) has emerged as a critical barometer for the health of the American industrial landscape. Reporting its results on February 11, 2026, the building materials giant showcased a bifurcated reality: while the broader economy grapples with

Via MarketMinute · February 13, 2026

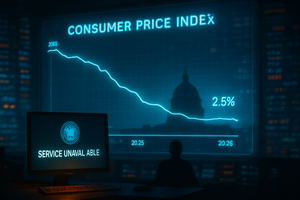

The U.S. housing market reached a pivotal turning point on February 13, 2026, as a "goldilocks" inflation report collided with a massive wave of industry consolidation. The Bureau of Labor Statistics released the January Consumer Price Index (CPI) this morning, revealing that headline inflation has cooled to 2.4%

Via MarketMinute · February 13, 2026

Over the last six months, Lennar’s shares have sunk to $119.99, producing a disappointing 8.3% loss - a stark contrast to the S&P 500’s 7.3% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Via StockStory · February 12, 2026

The financial world experienced a seismic shift on January 30, 2026, when President Donald Trump nominated Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. This move, long-telegraphed by the administration but still jarring to global markets, marks the beginning of what analysts are calling the

Via MarketMinute · February 12, 2026

The U.S. labor market just delivered a thunderclap that has reverberated from the halls of the Federal Reserve to the trading floors of Wall Street. In a stunning reversal of the "cooling" narrative that dominated the final months of 2025, the January jobs report released this morning revealed that

Via MarketMinute · February 12, 2026

As the calendar turns to mid-February 2026, the American economy stands at a critical juncture. Investors and policymakers are fixated on the upcoming release of the January Consumer Price Index (CPI) report, which is widely anticipated to show a year-over-year inflation rate of 2.5%. This follows a cooling trend

Via MarketMinute · February 12, 2026

There is a homebuilding shortage in the United States, and it represents a powerful secular trend worth investing in

Via The Motley Fool · February 11, 2026

As of February 11, 2026, the American real estate market is grappling with a profound "regime change" in monetary policy. The recent nomination of Kevin Warsh as Chairman of the Federal Reserve has introduced a dual-track strategy that is sending shockwaves through the housing sector. While the central bank has

Via MarketMinute · February 11, 2026

The morning of February 11, 2026, marks the end of a grueling "data blackout" for Wall Street. After a partial government shutdown that began on January 30th paralyzed the Bureau of Labor Statistics (BLS), the highly anticipated January employment situation report has finally been released. The delay, while only five

Via MarketMinute · February 11, 2026

As the first quarter of 2026 gets underway, the American economic landscape is being fundamentally reshaped by the "One Big Beautiful Bill Act" (OBBBA). Signed into law by President Trump following a heated legislative battle in late 2025, the sweeping fiscal package has begun to filter through the pockets of

Via MarketMinute · February 11, 2026

The fact that few others like it right now only adds to its potential upside.

Via The Motley Fool · February 10, 2026

With the era of Jerome Powell rapidly approaching its sunset, the financial world is grappling with a potential "regime change" that could fundamentally alter the relationship between the Federal Reserve, the economy, and the stock market. The recent nomination of Kevin Warsh to succeed Powell as Chair of the Board

Via MarketMinute · February 9, 2026

In a move that has sent shockwaves through global financial markets, the nomination of Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve has signaled a dramatic regime shift in American monetary policy. Announced on January 30, 2026, the decision marks the end of the "Powell

Via MarketMinute · February 6, 2026