Intercontinental Exchange (ICE)

164.81

+0.68 (0.41%)

NYSE · Last Trade: Mar 2nd, 3:48 PM EST

Prediction markets are exploding into mainstream chatter, and while Kalshi and Polymarket grab headlines, publicly traded plays may be the smarter way to invest in the boom.

Via The Motley Fool · February 27, 2026

While strong cash flow is a key indicator of stability, it doesn’t always translate to superior returns.

Some cash-heavy businesses struggle with inefficient spending, slowing demand, or weak competitive positioning.

Via StockStory · February 26, 2026

CoreCivic manages correctional and reentry facilities across the U.S., providing outsourced solutions for government agencies.

Via The Motley Fool · February 26, 2026

On February 2, 2026, AstraZeneca PLC (NYSE: AZN) officially rang the opening bell at the New York Stock Exchange, marking the completion of its high-profile transition from the Nasdaq. The move signals a major structural shift for the UK-based pharmaceutical leader, as it moves away from its long-standing American Depositary

Via MarketMinute · February 26, 2026

In a move that signals the most significant structural shift in American equity markets in decades, the financial world is bracing for a "23-hour" trading day. As of February 25, 2026, Nasdaq Inc. (Nasdaq: NDAQ) is in the final stages of a high-stakes regulatory review with the Securities and Exchange

Via MarketMinute · February 25, 2026

NEW YORK — Nasdaq, Inc. (NASDAQ: NDAQ) sent a clear message to Wall Street today during its highly anticipated 2026 Investor Day: the days of being viewed solely as a stock exchange are over. Standing before a packed room of analysts and institutional investors, CEO Adena Friedman unveiled an aggressive upward

Via MarketMinute · February 25, 2026

As of February 25, 2026, the S&P 500 index (NYSEArca:SPY) finds itself in a high-stakes tug-of-war between psychological resistance and robust underlying support. Following a historic surge that saw the index breach the 7,000-point threshold in late January, the market has entered a phase of "volatility compression.

Via MarketMinute · February 25, 2026

WASHINGTON, D.C. — As of February 24, 2026, the bedrock of American monetary policy is trembling. The Federal Reserve, an institution designed to operate above the fray of partisan politics, is currently besieged by a Department of Justice investigation into its Chair and a landmark Supreme Court battle over the

Via MarketMinute · February 24, 2026

The S&P 500 (^GSPC) is often seen as a benchmark for strong businesses, but that doesn’t mean every stock is worth owning.

Some companies face significant challenges, whether it’s stagnating growth, heavy debt, or disruptive new competitors.

Via StockStory · February 22, 2026

In a striking display of market resilience, shares of Coinbase Global, Inc. (Nasdaq: COIN) surged 16% today, February 17, 2026, as investors looked past a significant GAAP net loss to embrace the company’s aggressive capital return strategy and its evolving identity as a diversified financial powerhouse. The rally follows

Via MarketMinute · February 17, 2026

NEW YORK — The floor of the New York Stock Exchange (NYSE: ICE) sits silent today, February 16, 2026, as the U.S. financial markets observe the Presidents Day holiday. While the closure provides a momentary reprieve for traders, the atmosphere remains charged with anticipation following a highly divergent week of

Via MarketMinute · February 16, 2026

In a definitive move that reshapes the landscape of American mortgage finance, PennyMac Financial Services, Inc. (NYSE: PFSI) announced on February 11, 2026, that it has entered into a definitive agreement to acquire the subservicing business of Cenlar Capital Corporation. This $257.5 million deal marks a transformative shift for

Via MarketMinute · February 12, 2026

Intercontinental Exchange delivered a stronger-than-expected Q4, as revenue and non-GAAP EPS both exceeded Wall Street’s expectations, resulting in a positive market reaction. Management attributed the quarter’s results to broad-based growth across its exchange, fixed income, and mortgage technology segments. CEO Jeffrey Sprecher highlighted the “mission-critical nature” of ICE’s platforms during ongoing geopolitical and macroeconomic volatility, while CFO Warren Gardiner emphasized outperformance in expense synergies from the Black Knight acquisition and a disciplined approach to capital allocation supporting both operational investments and shareholder returns.

Via StockStory · February 12, 2026

Financial firms serve as the backbone of the economy, providing essential services from lending and investment management to risk management and payment processing. Still, investors are uneasy as companies face challenges from an unpredictable interest rate and inflation environment.

These doubts have caused the industry to lag recently as financials stocks have collectively shed 2.4% over the past six months. This performance is a noticeable divergence from the S&P 500’s 7.7% return.

Via StockStory · February 11, 2026

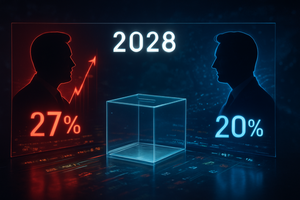

As the United States settles into the second year of the second Trump administration, the political world is already looking toward the horizon. While the 2026 midterms are the immediate hurdle, prediction markets are buzzing with high-stakes activity surrounding the 2028 Presidential Election. The early favorites have emerged with startling clarity: Vice President JD Vance [...]

Via PredictStreet · February 9, 2026

The digital asset landscape witnessed a seismic shift this week as Bullish (NYSE: BLSH), the institutional-grade crypto exchange, reported an explosive 70% year-over-year revenue growth in its latest quarterly earnings. Propelled by the meteoric rise of its newly launched options trading platform and a calculated expansion into the United States,

Via MarketMinute · February 9, 2026

As the prediction market industry enters its most volatile and high-stakes year to date, the internal rivalry between the sector’s two largest titans has spilled over into the markets themselves. On Manifold Markets, a high-liquidity "meta-market" titled "Top 1 prediction market by volume in 2026?" has become the primary scoreboard for what insiders are calling [...]

Via PredictStreet · February 8, 2026

The prediction market landscape shifted significantly this week as the world’s leading forecasting platform, Polymarket, officially commenced its transition to native USDC for on-chain settlement. In a strategic partnership with Circle Internet Group (NYSE: CRCL), the move marks the definitive end of the "bridged asset" era for the platform, replacing the older, more vulnerable USDC.e [...]

Via PredictStreet · February 8, 2026

While the dust of the 2024 election has long since settled, the gaze of the political and financial worlds has already shifted toward the next horizon. As of February 7, 2026, prediction markets for the 2028 Democratic Nominee have reached an unprecedented level of early activity. On Kalshi, the premier regulated event contract exchange, the [...]

Via PredictStreet · February 7, 2026

The landscape of global finance shifted permanently this winter as the Intercontinental Exchange (NYSE: ICE) finalized a staggering $2 billion strategic investment into Polymarket. For years, prediction markets were viewed as the "Wild West" of decentralized finance—a niche playground for crypto-natives and political junkies. However, with the backing of the world’s most powerful exchange operator, [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the intersection of high finance and political power has reached a new frontier. The Trump family, led by Donald Trump Jr., has successfully pivoted from the political arena into the bedrock of the global "Information Finance" (InfoFi) movement. With strategic advisory roles at the industry’s two largest platforms, Kalshi and [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the prediction market landscape has officially transitioned from a niche corner of the internet into a high-stakes battleground for global financial supremacy. Dubbed "The Great Prediction War of 2026," the industry is currently witnessing an unprecedented clash between the decentralized heavyweight Polymarket and the federally regulated Kalshi. At the center [...]

Via PredictStreet · February 6, 2026

Global market infrastructure company Intercontinental Exchange (NYSE:ICE) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.8% year on year to $2.50 billion. Its non-GAAP profit of $1.71 per share was 2.2% above analysts’ consensus estimates.

Via StockStory · February 6, 2026

In a move that signals the complete integration of digital assets into the global financial architecture, CME Group (NASDAQ: CME) has announced the expansion of its cryptocurrency derivatives suite to include Cardano (ADA), Chainlink (LINK), and Polkadot (DOT). The launch, set to take place on February 9, 2026, is paired

Via MarketMinute · February 5, 2026

While the dust of the 2024 election cycle has barely settled, the financial world is already placing its bets on the next battle for the White House. As of February 2026, prediction markets—the once-niche platforms that successfully forecasted the 2024 outcome with surgical precision—are signaling a clear trajectory for the 2028 U.S. Presidential Election. Vice [...]

Via PredictStreet · February 5, 2026