iShares U.S. Insurance ETF (IAK)

129.93

-1.02 (-0.78%)

NYSE · Last Trade: Jan 24th, 7:38 AM EST

Detailed Quote

| Previous Close | 130.95 |

|---|---|

| Open | 130.40 |

| Day's Range | 129.06 - 130.85 |

| 52 Week Range | 119.23 - 138.99 |

| Volume | 29,679 |

| Market Cap | 7.54M |

| Dividend & Yield | 2.668 (2.05%) |

| 1 Month Average Volume | 56,976 |

Chart

News & Press Releases

UnitedHealth Pledges ACA Profit Rebates Amid Subsidy Debate – But Retail Sees Rally Toward $400stocktwits.com

Via Stocktwits · January 21, 2026

Abundia highlighted key objectives for the year, including the acquisition of RPD Technologies by the first-quarter and the completion of Phase 1 at the Cedar Port Innovation Center by second-quarter.

Via Stocktwits · January 13, 2026

The $340 mark coincides with the stock’s 50-day moving average (50-DMA), currently at around $340.71 – a key hurdle which, if crossed, will be considered as a positive signal for the short term.

Via Stocktwits · December 12, 2025

Travelers reported strong Q3 earnings, beating estimates with $8.14 EPS and 5% revenue growth, but shares traded lower premarket.

Via Benzinga · October 16, 2025

Radian Group Inc. (NYSE: RDN) to acquire Inigo Limited, a Lloyds Banking Group (NYSE: LYG) specialty insurer, in a $1.7 billion deal.

Via Benzinga · September 18, 2025

Mark Cuban flagged growing concerns within the insurance sector as Antarctic ice loss may have reached a dangerous tipping point.

Via Benzinga · August 22, 2025

Mark Cuban has unveiled a bold plan to revolutionize the U.S. healthcare system, eliminating traditional insurance premiums.

Via Benzinga · June 17, 2025

Brown & Brown Inc. to acquire Accession Risk Management Group for $9.825 billion, expanding its reach and offerings in the insurance industry.

Via Benzinga · June 10, 2025

Travelers (TRV) to sell Canadian personal & commercial insurance ops for $2.4B to Definity (DFY). Deal to close in Q1 2026, TRV to allocate $0.7B to share buybacks.

Via Benzinga · May 28, 2025

Travelers Companies, Inc. (TRV) reports higher sales in Q1, beating analyst estimates and increasing dividend.

Via Benzinga · April 16, 2025

Mark Cuban has called the U.S. healthcare system, "f****d up" while highlighting insurance-designed deductibles as the problem.

Via Benzinga · February 25, 2025

AIG shares down after reporting Q4 EPS of $1.30, above consensus but below analyst's estimate due to underwriting results and expenses.

Via Benzinga · February 12, 2025

California-based insurance stocks and ETFs are in focus as the LA wildfires have wreaked havoc and ruined more than 10,000 structures.

Via Benzinga · January 10, 2025

The insurance industry recently saw some strong earnings reports as some of the more prominent players surpassed estimates for earnings, revenues, or both. This led to a rally in insurance ETFs. Here is a brief look at funds that may have benefited.

Via Talk Markets · November 16, 2024

Travelers Companies reported 12% revenue growth and core income per share of $5.24, beating consensus. Strong underwriting and investment income drove the growth.

Via Benzinga · October 17, 2024

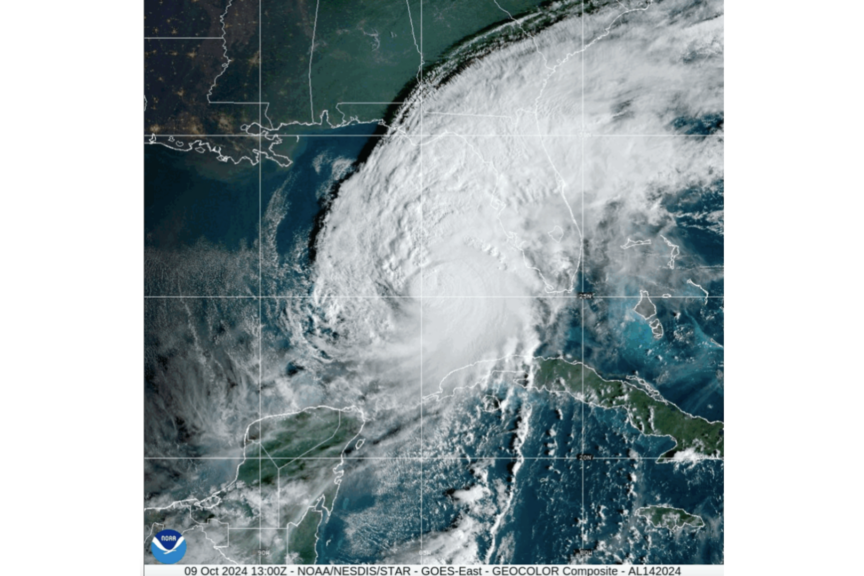

Floridians already pay high homeowners' insurance premiums in the U.S. The recent pair of hurricanes make a bad situation worse.

Via Benzinga · October 14, 2024

In the current scenario, investors should bet on ETFs that have been winners so far this year.

Via Talk Markets · October 14, 2024

For a look at how hurricanes are categorized, and what it means for sustained wind speeds, Benzinga offers a breakdown.

Via Benzinga · October 9, 2024

SelectQuote is a different type of insurance company that some analysts think could rise by over 100%. Its business model has some interesting advantages.

Via MarketBeat · October 9, 2024

Analyst downgraded Chubb Limited to Underperform, citing slower growth and lower operating leverage compared to peers despite premium valuation.

Via Benzinga · October 4, 2024

Sector ETFs, which are the major beneficiaries of a rate cut, rallied to new 52-week highs.

Via Talk Markets · September 20, 2024

This article lists four ETFs from different sectors that have gained from strong earnings despite the market volatility.

Via Talk Markets · August 28, 2024

Allstate sells Employer Voluntary Benefits business to StanCorp for $2.0B, expects decrease in adjusted net income return on equity, to close in 2025

Via Benzinga · August 14, 2024

Travelers Companies (NYSE: TRV) reports strong Q2 results with 12% revenue growth, $2.51 core income per share, and 8% increase in premiums.

Via Benzinga · July 19, 2024

The next market rotation could be into insurance stocks and they could rally as much as 30%, according to an investment advisor.

Via Benzinga · May 18, 2024