General Motors (GM)

83.11

+1.89 (2.33%)

NYSE · Last Trade: Feb 18th, 3:10 PM EST

Detailed Quote

| Previous Close | 81.22 |

|---|---|

| Open | 81.95 |

| Bid | 83.10 |

| Ask | 83.12 |

| Day's Range | 81.70 - 83.93 |

| 52 Week Range | 41.60 - 87.62 |

| Volume | 4,573,331 |

| Market Cap | 75.13B |

| PE Ratio (TTM) | 25.65 |

| EPS (TTM) | 3.2 |

| Dividend & Yield | 0.6000 (0.72%) |

| 1 Month Average Volume | 9,210,114 |

Chart

About General Motors (GM)

General Motors is a leading global automotive company that designs, manufactures, and sells a diverse range of vehicles, including cars, trucks, and SUVs under various brand names. The company is committed to innovation in transportation, focusing on the development of electric and autonomous vehicles to meet the evolving needs of consumers and address environmental challenges. With a rich history in the automotive industry, General Motors also emphasizes safety, performance, and technology integration in its products while working toward sustainability initiatives and expanding its presence in the global market. Read More

News & Press Releases

General Motors Company (NYSE:GM) shares are rising Wednesday after a new investment in a Canadian assembly facility.

Via Benzinga · February 18, 2026

As of February 18, 2026, the United States economy is grappling with the most aggressive shift in trade policy since the Great Depression. The Trump administration’s universal baseline tariff has pushed the average import tax to a staggering 13%, a level not seen in nine decades. While the stock

Via MarketMinute · February 18, 2026

Spotify, Datadog, and Ferrari caught the attention of these investors.

Via The Motley Fool · February 17, 2026

In a dramatic shift for the electric vehicle sector, shares of Rivian Automotive, Inc. (NASDAQ: RIVN) surged more than 26% following a blockbuster fourth-quarter earnings report and confirmed progress on its multi-billion-dollar joint venture with Volkswagen Group (OTC: VWAGY). The rally, which saw the stock climb to $17.73 by

Via MarketMinute · February 17, 2026

Investors should consider these underappreciated stocks before others take notice.

Via The Motley Fool · February 17, 2026

While the S&P 500 (^GSPC) includes industry leaders, not every stock in the index is a winner.

Some companies are past their prime, weighed down by poor execution, weak financials, or structural headwinds.

Via StockStory · February 16, 2026

Detroit-based GM has no plans to discontinue Chevrolet Silverado EV despite Trump administration's EPA rollback.

Via Benzinga · February 17, 2026

In a move that has sent shockwaves through the global battery metals sector, Albemarle Corporation (NYSE:ALB) officially announced on February 11, 2026, that it will idle the remaining operations at its flagship Kemerton lithium hydroxide plant in Western Australia. This decision marks the final chapter in a multi-year restructuring

Via MarketMinute · February 16, 2026

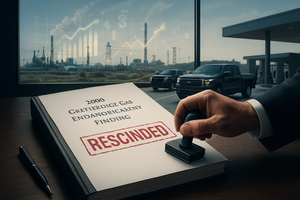

In a move that has sent shockwaves through the global automotive and energy markets, the Environmental Protection Agency (EPA) finalized a rule on February 12, 2026, rescinding the landmark 2009 Greenhouse Gas Endangerment Finding. This historic decision effectively dismantles the legal foundation for federal greenhouse gas (GHG) regulations under the

Via MarketMinute · February 16, 2026

On February 16, 2026, the electric vehicle (EV) sector witnessed a seismic shift in investor sentiment as Rivian Automotive (NASDAQ: RIVN) surged by 26.6% in a single trading session. This dramatic rally, which pushed the stock to $17.73, followed a blockbuster 2026 outlook and a series of strategic partnership headlines that have effectively silenced long-standing [...]

Via Finterra · February 16, 2026

The company's vision of the transportation market is revolutionary, and the company is betting big on it.

Via The Motley Fool · February 16, 2026

Nio and Rivian are both relatively young EV producers, but the market conditions they're faced with could not be more different.

Via The Motley Fool · February 16, 2026

Value stocks typically trade at discounts to the broader market, offering patient investors the opportunity to buy businesses when they’re out of favor.

The key risk, however, is that these stocks are usually cheap for a reason – five cents for a piece of fruit may seem like a great deal until you find out it’s rotten.

Via StockStory · February 15, 2026

Tesla's core EV business appears to be hitting a wall, forcing it to accelerate the developmental timelines of several of its side projects.

Via The Motley Fool · February 15, 2026

Turning around its business in Europe will be a big win, but what it could learn from a Chinese rival might be even more valuable.

Via The Motley Fool · February 14, 2026

Turning around its business in China is important to General Motors and its investors, and there's a little good news in that area.

Via The Motley Fool · February 14, 2026

Dauch (DCH) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 13, 2026

As of February 13, 2026, the American consumer is signaling a profound state of distress that stands in stark contrast to the resilient spending patterns seen just two years ago. The latest reading of the University of Michigan’s Consumer Sentiment Index has plummeted to 57.3, its lowest level

Via MarketMinute · February 13, 2026

Trump ends EV era with EPA rollback. Ford, GM, and truckers gain as emission costs vanish and the "endangerment finding" is repealed.

Via Benzinga · February 13, 2026

The finding by the Obama administration forms the basis for U.S. actions to reduce greenhouse emissions and fight climate change, including the laws on vehicle tailpipe emissions which have aided the transition to electric vehicles.

Via Stocktwits · February 12, 2026

Salesforce signed a deal to acquire Cimulate, an AI-powered product discovery startup. The acquisition strengthens Agentforce Commerce with better search and personalized shopping.

Via Barchart.com · February 12, 2026

It's hugely important for investors to stay aware of which automakers' products are well received.

Via The Motley Fool · February 12, 2026

GM increased its 2026 dividend by 20%, and while its dividend yield is below Ford's, it looks like a better buy compared to the Blue Oval.

Via Barchart.com · February 11, 2026

In a dramatic shift that has caught many Wall Street analysts off guard, the first two weeks of February 2026 have witnessed a historic "Great Rotation" within the equity markets. The Russell 2000 Index (IWM), which tracks domestic small-cap companies, has staged its most aggressive rally in decades, significantly outperforming

Via MarketMinute · February 11, 2026

The S&P 500 Index retreated further from its historic peaks on Wednesday, closing at 6,914.75, a decline of 0.39% for the session. This pullback marks a significant cooling period for a market that only weeks ago, on January 28, 2026, celebrated a record-shattering high of 7,

Via MarketMinute · February 11, 2026