EQT Corp (EQT)

59.58

+0.20 (0.34%)

NYSE · Last Trade: Feb 26th, 11:49 AM EST

As of February 26, 2026, Coterra Energy Inc. (NYSE: CTRA) stands at the precipice of its most significant transformation since its inception. Once the product of a bold 2021 merger between a natural gas giant and a Permian pure-play, Coterra has spent the last five years proving the merits of a "multi-basin" strategy. Today, however, [...]

Via Finterra · February 26, 2026

The natural gas market has undergone a dramatic reversal in late February 2026, as the "weather premium" that propelled prices to historic highs just weeks ago has completely evaporated. After a period of extreme volatility, natural gas prices have surrendered to persistent negative pressure, decisively breaking below the critical $3.

Via MarketMinute · February 26, 2026

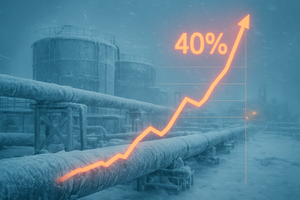

The U.S. Energy Information Administration (EIA) has sent shockwaves through the energy markets with the release of its February 2026 Short-Term Energy Outlook (STEO), significantly upwardly revising near-term natural gas price forecasts by a staggering 40%. The revision comes in the wake of "Winter Storm Fern," an aggressive Arctic

Via MarketMinute · February 25, 2026

EQT Corp (NYSE:EQT) Combines High Growth Momentum with Bullish Technical Setupchartmill.com

Via Chartmill · February 25, 2026

EQT CORP (NYSE:EQT) Reports Q4 2025 Earnings Beat on EPS Despite Revenue Misschartmill.com

Via Chartmill · February 17, 2026

US natural gas prices have undergone a violent transformation in early 2026, with the Henry Hub benchmark surging 78% to reach $7.82 per million British thermal units (MMBtu). This represents the highest sustained price level since the global energy crisis of late 2022, signaling a definitive end to the

Via MarketMinute · February 24, 2026

The United States energy market is reeling after a historic mid-winter "perfect storm" sent natural gas prices skyrocketing by more than 78% in the first weeks of 2026. This dramatic escalation, driven by a combination of record-breaking Arctic temperatures and structural supply constraints, has rippled through the broader economy, contributing

Via MarketMinute · February 23, 2026

The American energy landscape was sent into a tailspin in early 2026 as U.S. natural gas prices experienced a staggering 78.4% spike, a move that reverberated through global commodities and sent shockwaves across industrial and residential sectors. This unprecedented volatility was the primary driver behind a 12% surge

Via MarketMinute · February 20, 2026

In a month defined by atmospheric volatility, the U.S. natural gas market has undergone a historic convulsion. Prices on the New York Mercantile Exchange (NYMEX) recently skyrocketed, with front-month futures jumping a staggering 18.1% in a single session to settle at $7.8270 per million British thermal units

Via MarketMinute · February 19, 2026

EQT (EQT) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 18, 2026

The natural gas market faced a decisive technical breakdown today, February 17, 2026, as prices officially breached the long-held $3.20 per million British thermal units (MMBtu) support level. A combination of unseasonably warm weather forecasts and a federal storage report that failed to meet market expectations has sent the

Via MarketMinute · February 17, 2026

The United States natural gas market is currently navigating a period of extraordinary volatility, transitioning from a historic price surge in January to a rapid cooling phase as of February 11, 2026. Just weeks ago, Winter Storm Fern gripped the nation, driving spot prices to record highs and forcing the

Via MarketMinute · February 11, 2026

As of February 6, 2026, the dominant narrative on Wall Street has shifted from the virtual to the tangible. After years of dominance by Silicon Valley’s software giants, a powerful "Great Rotation" is underway, with institutional capital aggressively migrating toward the backbone of the physical economy. Investors are increasingly

Via MarketMinute · February 6, 2026

The U.S. energy market was rocked in January 2026 as natural gas prices skyrocketed by a staggering 78.4%, catapulting from a December average of $4.25 per million BTU to a peak average of $7.58. This historic surge, detailed in the latest World Bank Commodity Markets report,

Via MarketMinute · February 6, 2026

The U.S. stock market is currently witnessing a tectonic shift in capital allocation as the "AI hype cycle" of the early 2020s gives way to the "Physical Reality" of 2026. In the first five weeks of the year, a massive sector rotation has seen billions of dollars exit high-multiple

Via MarketMinute · February 5, 2026

These S&P500 stocks are moving in today's sessionchartmill.com

Via Chartmill · February 2, 2026

What's going on in today's session: S&P500 moverschartmill.com

Via Chartmill · February 2, 2026

The books closed on 2025 with the global natural gas market presenting a striking study in regional contrast. While American consumers and industrial users grappled with a sharp 12.1% surge in Henry Hub prices during December, their counterparts in Europe and Australia enjoyed a surprising reprieve. The Dutch TTF,

Via MarketMinute · February 2, 2026

Gapping S&P500 stocks in Monday's sessionchartmill.com

Via Chartmill · February 2, 2026

Discover the top S&P500 movers in Monday's pre-market session.chartmill.com

Via Chartmill · February 2, 2026

The long-standing economic alliance between the United States and Canada reached a perilous breaking point this week. As of January 30, 2026, the North American trading block—once the most integrated and prosperous in the world—is staring down a "nuclear" economic option. President Donald Trump, entering the second year

Via MarketMinute · January 30, 2026

The final week of January 2026 has etched itself into the annals of energy market history as a brutal Arctic front, dubbed "Winter Storm Fern," paralyzed much of the United States. This extreme weather event transformed the natural gas market into a theater of unprecedented volatility, where supply-demand balances tightened

Via MarketMinute · January 30, 2026

The global natural gas market witnessed an extraordinary "great divergence" in December 2025, as a brutal cold snap in North America sent domestic prices soaring while a mild, windy winter in Europe allowed the continent’s energy crisis fears to cool. U.S. natural gas futures surged by 12.1%

Via MarketMinute · January 28, 2026

EQT is cashing in on surging gas demand.

Via The Motley Fool · January 27, 2026

In a volatile trading session that has stunned energy analysts, U.S. natural gas futures skyrocketed nearly 28% on Tuesday, January 27, 2026, settling at $6.78 per million British thermal units (MMBtu). The massive price jump marks one of the most significant single-day gains in the history of the

Via MarketMinute · January 27, 2026