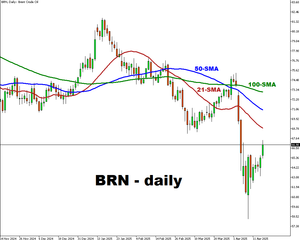

United States Brent Oil Fund, LP ETV (BNO)

29.11

-0.20 (-0.68%)

NYSE · Last Trade: Jun 27th, 6:48 PM EDT

Detailed Quote

| Previous Close | 29.31 |

|---|---|

| Open | 29.39 |

| Day's Range | 28.98 - 29.47 |

| 52 Week Range | 24.72 - 33.38 |

| Volume | 1,008,952 |

| Market Cap | 135.36M |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 1,289,197 |

Chart

News & Press Releases

Oil prices such as United States Brent Oil Fund (NYSE: BNO) and the United States Oil Fund (NYSE: USO) are trading lower Tuesday. The selloff follows news that a tentative ceasefire between Israel and Iran may be in effect, reducing immediate concerns over further military escalation in the oil-rich Middle East region.

Via Benzinga · June 24, 2025

Oil prices can shoot up if Iran decides to shut the Strait of Hormuz. If tensions further intensify, energy and defense ETFs may gain.

Via Benzinga · June 23, 2025

Middle East conflict boosts demand for 'crisis alpha' ETFs in defense, energy, inflation, and cybersecurity sectors, as investors fear market volatility.

Via Benzinga · June 13, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Monday, April 28.

Via Talk Markets · April 28, 2025

A look at the bull setup in BTCUSD and the relative outperformance from global defense stocks.

Via Talk Markets · April 28, 2025

Conflicting signals is keeping oil locked in a trading range.

Via Talk Markets · April 25, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Thursday, April 24.

Via Talk Markets · April 24, 2025

Asian stock markets presented a mixed picture on Thursday, suggesting investor caution quickly returned following a significant relief rally on Wall Street.

Via Talk Markets · April 24, 2025

Growing disagreements between OPEC+ members have oil sitting out the broader risk-on move seen across financial markets as tariff tensions ease.

Via Talk Markets · April 24, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Wednesday, April 23.

Via Talk Markets · April 23, 2025

Risk assets staged a recovery yesterday amid growing hopes for a de-escalation in US-China trade tensions. President Trump also eased concerns he might fire Federal Reserve Chair Powell.

Via Talk Markets · April 23, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Tuesday, April 22.

Via Talk Markets · April 22, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Monday, April 21.

Via Talk Markets · April 21, 2025

WTI Crude Oil went into the weekend near the 63.500 mark before the long holiday weekend began.

Via Talk Markets · April 20, 2025

Brent rose above $67 on Thursday, extending gains for a second session, after new US sanctions on Iran's oil sector and a Chinese refinery heightened supply concerns.

Via Talk Markets · April 18, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Wednesday, April 16.

Via Talk Markets · April 16, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Tuesday, April 15.

Via Talk Markets · April 15, 2025

The cartel now anticipates a demand increase of 1.3 million barrels per day (bpd) for 2025, down 150,000 bpd from its previous projection. Similarly, the 2026 forecast has been adjusted downward to 1.28 million bpd.

Via Talk Markets · April 15, 2025

Oil prices rose yesterday despite OPEC making some small downward revisions to demand growth estimates.

Via Talk Markets · April 14, 2025

Brent crude oil price has formed a giant descending triangle this year.

Via Talk Markets · April 13, 2025

This market isn’t pricing in panic, but it’s not showing any signs of life either.

Via Talk Markets · April 12, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Friday, April 11.

Via Talk Markets · April 12, 2025

Brent crude oil steadied near $63 a barrel on Friday, heading for its second straight weekly drop as worries over weakening global demand intensified.

Via Talk Markets · April 11, 2025

In this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Thursday, April 10.

Via Talk Markets · April 10, 2025

Trump surprised markets with a 90-day pause in reciprocal tariffs for most trading partners. This provided a boost to risk assets, including commodities. However, there’s still plenty of uncertainty as the US again increased tariffs on China.

Via Talk Markets · April 10, 2025