As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the data analytics industry, including Amplitude (NASDAQ:AMPL) and its peers.

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

The 7 data analytics stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 12.9% since the latest earnings results.

Amplitude (NASDAQ:AMPL)

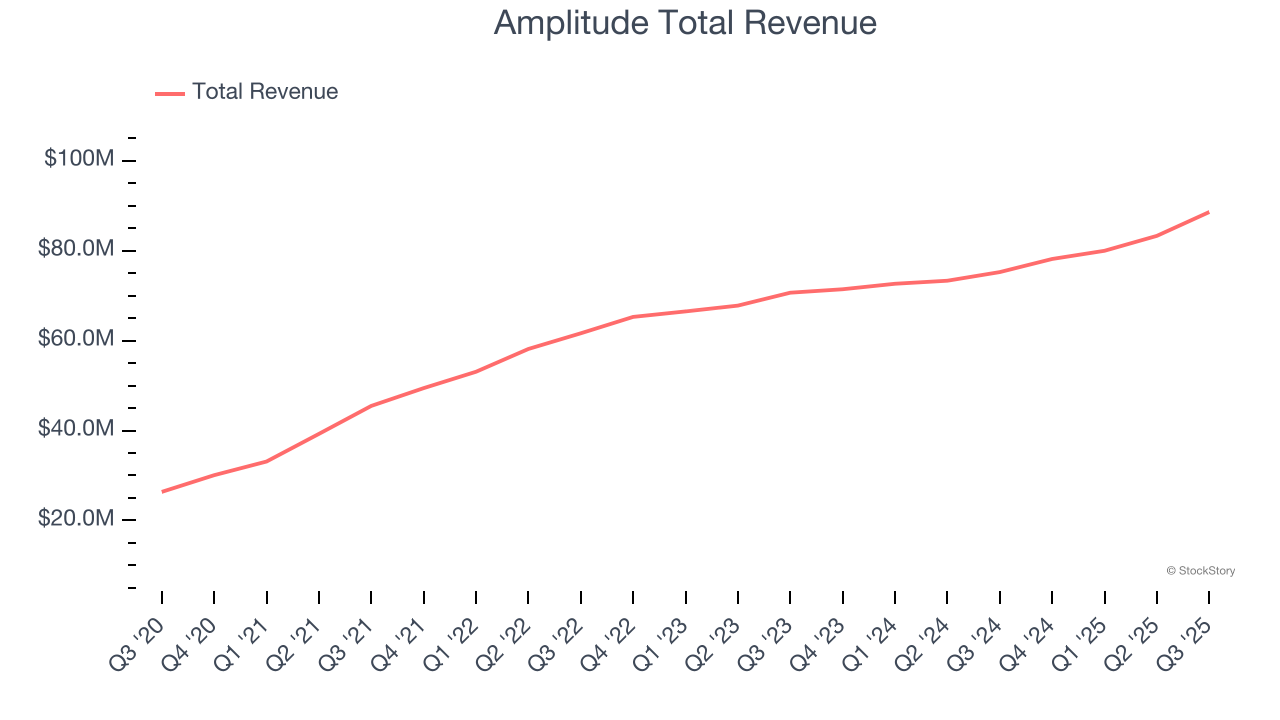

Born from the realization that companies were flying blind when it came to understanding user behavior in their digital products, Amplitude (NASDAQ:AMPL) provides a digital analytics platform that helps businesses understand how people use their digital products to improve user experiences and drive revenue growth.

Amplitude reported revenues of $88.56 million, up 17.7% year on year. This print exceeded analysts’ expectations by 2.6%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

"AI is changing how software gets built," said Spenser Skates, CEO and co-founder of Amplitude.

Interestingly, the stock is up 14.1% since reporting and currently trades at $11.00.

Is now the time to buy Amplitude? Access our full analysis of the earnings results here, it’s free for active Edge members.

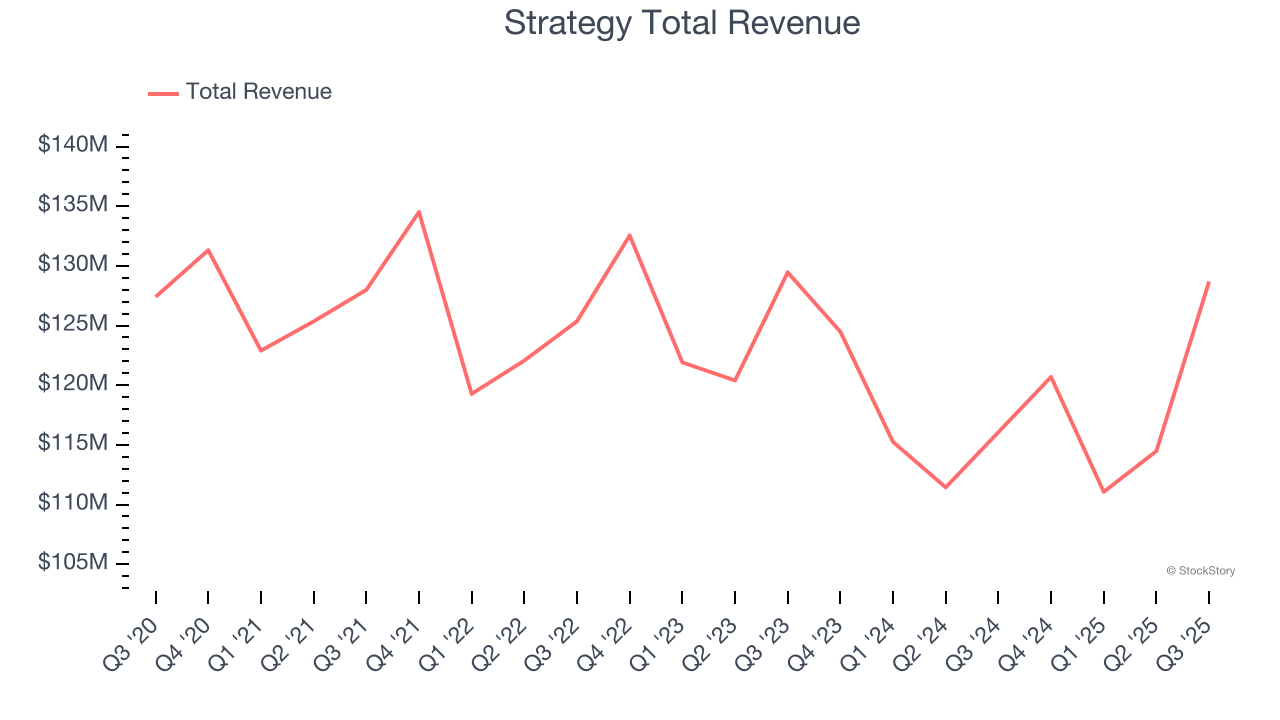

Best Q3: Strategy (NASDAQ:MSTR)

Once a traditional business intelligence software provider, Strategy (NASDAQ:MSTR) develops AI-powered enterprise analytics software while also functioning as a major corporate holder of Bitcoin cryptocurrency.

Strategy reported revenues of $128.7 million, up 10.9% year on year, outperforming analysts’ expectations by 9.1%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Strategy achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 35.4% since reporting. It currently trades at $164.74.

Is now the time to buy Strategy? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Health Catalyst (NASDAQ:HCAT)

Built on its "Health Catalyst Flywheel" methodology that emphasizes measurable outcomes, Health Catalyst (NASDAQ:HCAT) provides data and analytics technology and services that help healthcare organizations manage their data and drive measurable clinical, financial, and operational improvements.

Health Catalyst reported revenues of $76.32 million, flat year on year, exceeding analysts’ expectations by 1.7%. Still, it was a slower quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and EBITDA guidance for next quarter missing analysts’ expectations significantly.

As expected, the stock is down 19.8% since the results and currently trades at $2.33.

Read our full analysis of Health Catalyst’s results here.

CLEAR Secure (NYSE:YOU)

Recognized by its signature blue lanes and biometric pods at airport checkpoints across America, CLEAR Secure (NYSE:YOU) provides biometric identity verification technology that allows subscribers to bypass regular security lines at airports and access secure experiences at various venues.

CLEAR Secure reported revenues of $229.2 million, up 15.5% year on year. This print beat analysts’ expectations by 1.9%. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

The company added 57 customers to reach a total of 7,683. The stock is up 10.9% since reporting and currently trades at $35.25.

Read our full, actionable report on CLEAR Secure here, it’s free for active Edge members.

Domo (NASDAQ:DOMO)

Named for the Japanese word meaning "thank you very much," Domo (NASDAQ:DOMO) provides a cloud-based business intelligence platform that connects people with real-time data and insights across organizations.

Domo reported revenues of $79.4 million, flat year on year. This number met analysts’ expectations. Zooming out, it was a satisfactory quarter as it also recorded EPS guidance for next quarter exceeding analysts’ expectations but a significant miss of analysts’ billings estimates.

Domo pulled off the highest full-year guidance raise but had the weakest performance against analyst estimates and weakest performance against analyst estimates among its peers. The stock is down 28% since reporting and currently trades at $8.33.

Read our full, actionable report on Domo here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.