Looking back on renewable energy stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Bloom Energy (NYSE:BE) and its peers.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 18 renewable energy stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 5.2% while next quarter’s revenue guidance was 1.1% above.

Luckily, renewable energy stocks have performed well with share prices up 19.8% on average since the latest earnings results.

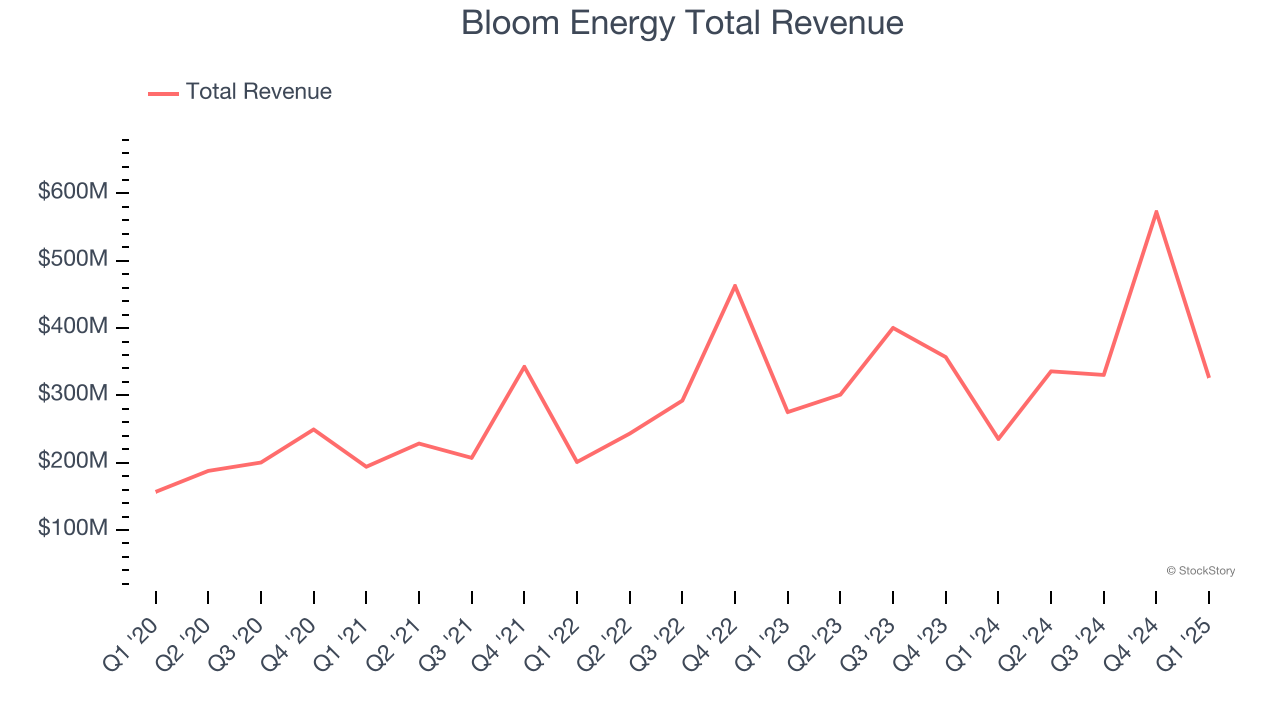

Bloom Energy (NYSE:BE)

Working in stealth mode for eight years, Bloom Energy (NYSE:BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

Bloom Energy reported revenues of $326 million, up 38.6% year on year. This print exceeded analysts’ expectations by 11.9%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Interestingly, the stock is up 21.9% since reporting and currently trades at $22.30.

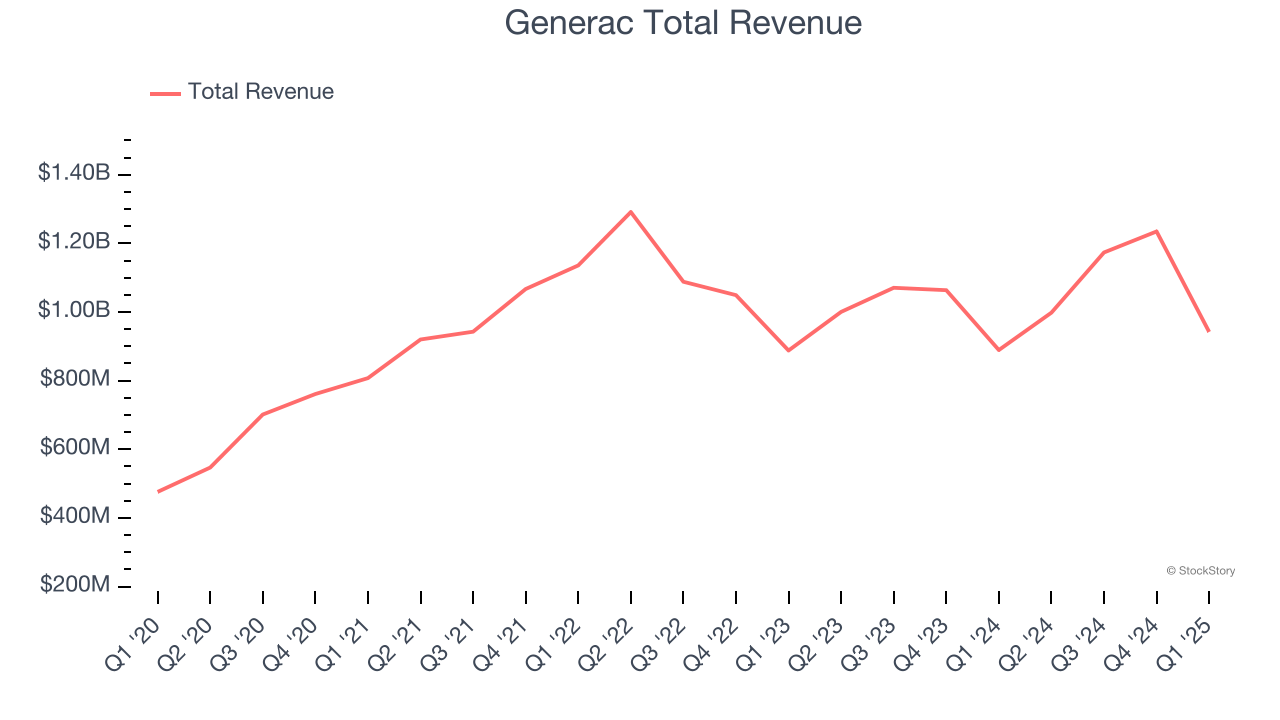

Best Q1: Generac (NYSE:GNRC)

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE:GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $942.1 million, up 5.9% year on year, outperforming analysts’ expectations by 2.3%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 25.9% since reporting. It currently trades at $142.51.

Is now the time to buy Generac? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Blink Charging (NASDAQ:BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ:BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $20.75 million, down 44.8% year on year, falling short of analysts’ expectations by 24.3%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Blink Charging delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 17.1% since the results and currently trades at $1.01.

Read our full analysis of Blink Charging’s results here.

Plug Power (NASDAQ:PLUG)

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ:PLUG) provides hydrogen fuel cells used to power electric motors.

Plug Power reported revenues of $133.7 million, up 11.2% year on year. This print topped analysts’ expectations by 1.3%. However, it was a slower quarter as it logged a significant miss of analysts’ EBITDA estimates and a miss of analysts’ EPS estimates.

The stock is up 37.2% since reporting and currently trades at $1.24.

Read our full, actionable report on Plug Power here, it’s free.

Shoals (NASDAQ:SHLS)

Started in Huntsville, Alabama, Shoals (NASDAQ:SHLS) designs and manufactures products that make solar energy systems work more efficiently.

Shoals reported revenues of $80.36 million, down 11.5% year on year. This result beat analysts’ expectations by 8.3%. Overall, it was a very strong quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates and full-year EBITDA guidance exceeding analysts’ expectations.

The stock is up 29.7% since reporting and currently trades at $4.89.

Read our full, actionable report on Shoals here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.