Hospital operator HCA Healthcare (NYSE:HCA) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 5.7% year on year to $18.32 billion. The company expects the full year’s revenue to be around $74.3 billion, close to analysts’ estimates. Its GAAP profit of $6.45 per share was 11.5% above analysts’ consensus estimates.

Is now the time to buy HCA Healthcare? Find out by accessing our full research report, it’s free.

HCA Healthcare (HCA) Q1 CY2025 Highlights:

- Revenue: $18.32 billion vs analyst estimates of $18.23 billion (5.7% year-on-year growth, 0.5% beat)

- EPS (GAAP): $6.45 vs analyst estimates of $5.78 (11.5% beat)

- Adjusted EBITDA: $3.73 billion vs analyst estimates of $3.53 billion (20.4% margin, 5.7% beat)

- EPS (GAAP) guidance for the full year is $24.95 at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $14.7 billion at the midpoint, in line with analyst expectations

- Operating Margin: 20.3%, up from 17.1% in the same quarter last year

- Free Cash Flow Margin: 3.6%, down from 7.8% in the same quarter last year

- Market Capitalization: $84.06 billion

“The solid fundamentals we saw in our business the past several quarters continued into the first quarter of 2025,” said Sam Hazen, Chief Executive Officer of HCA Healthcare.

Company Overview

With roots dating back to 1968 and a network spanning 20 states, HCA Healthcare (NYSE:HCA) operates a network of 190 hospitals and 150+ outpatient facilities providing a full range of medical services across the US and England.

Hospital Chains

Hospital chains operate scale-driven businesses that rely on patient volumes, efficient operations, and favorable payer contracts to drive revenue and profitability. These organizations benefit from the essential nature of their services, which ensures consistent demand, particularly as populations age and chronic diseases become more prevalent. However, profitability can be pressured by rising labor costs, regulatory requirements, and the challenges of balancing care quality with cost efficiency. Dependence on government and private insurance reimbursements also introduces financial uncertainty. Looking ahead, hospital chains stand to benefit from tailwinds such as increasing healthcare utilization driven by an aging population that generally has higher incidents of disease. AI can also be a tailwind in areas such as predictive analytics for more personalized treatment and efficiency (intake, staffing, resourcing allocation). However, the sector faces potential headwinds such as labor shortages that could push up wages as well as substantial investments needs for digital infrastructure to support telehealth and electronic health records. Regulatory scrutiny, and reimbursement cuts are also looming topics that could further strain margins.

Sales Growth

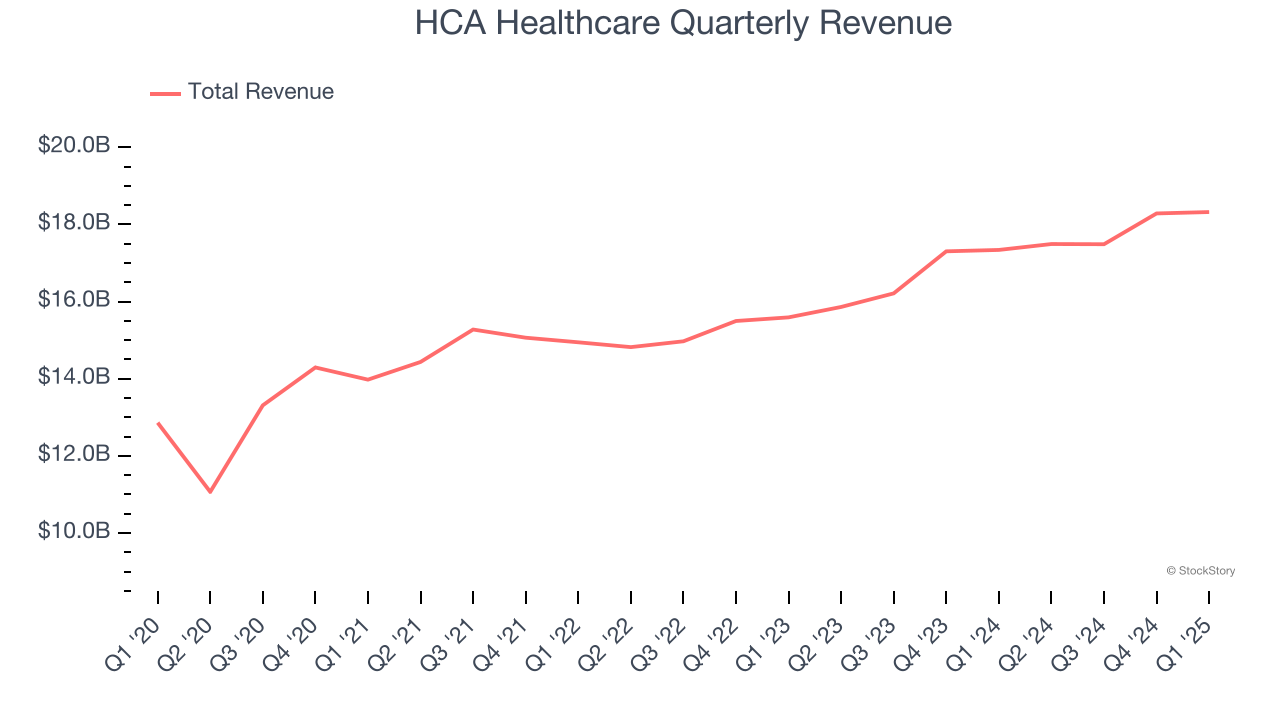

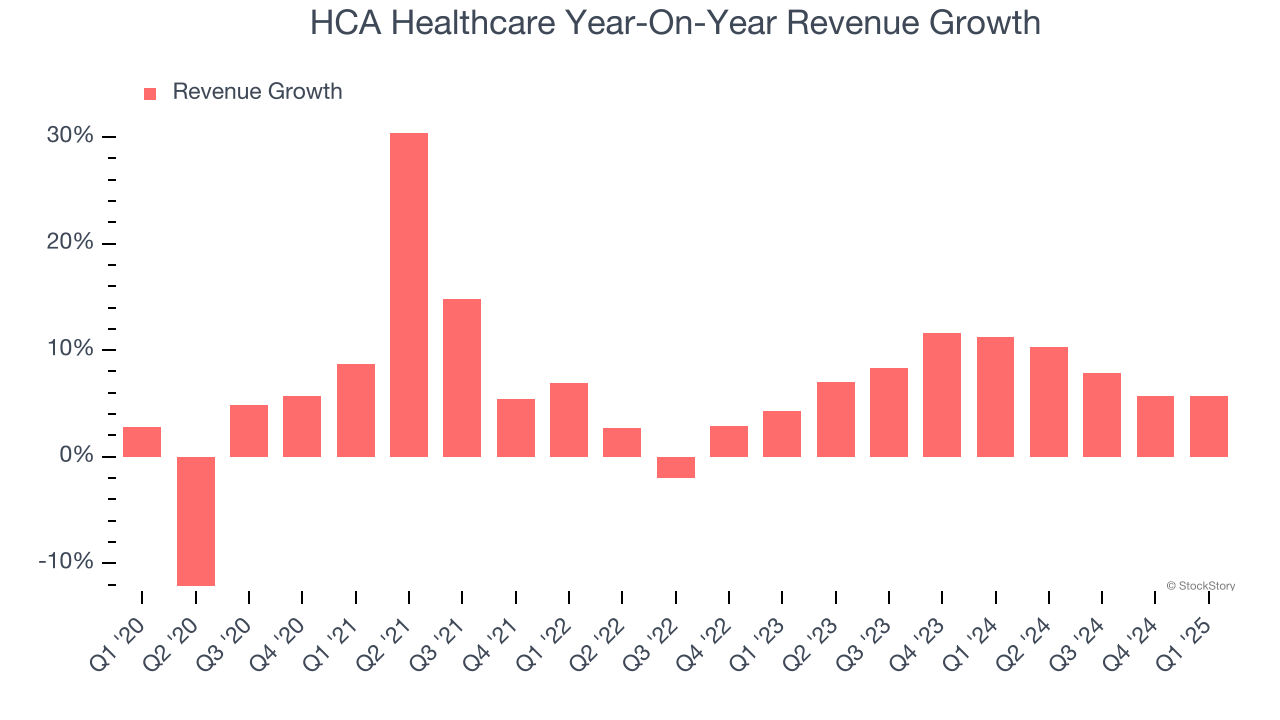

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, HCA Healthcare’s sales grew at a mediocre 6.7% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the healthcare sector, but there are still things to like about HCA Healthcare.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. HCA Healthcare’s annualized revenue growth of 8.4% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, HCA Healthcare reported year-on-year revenue growth of 5.7%, and its $18.32 billion of revenue exceeded Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and suggests the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

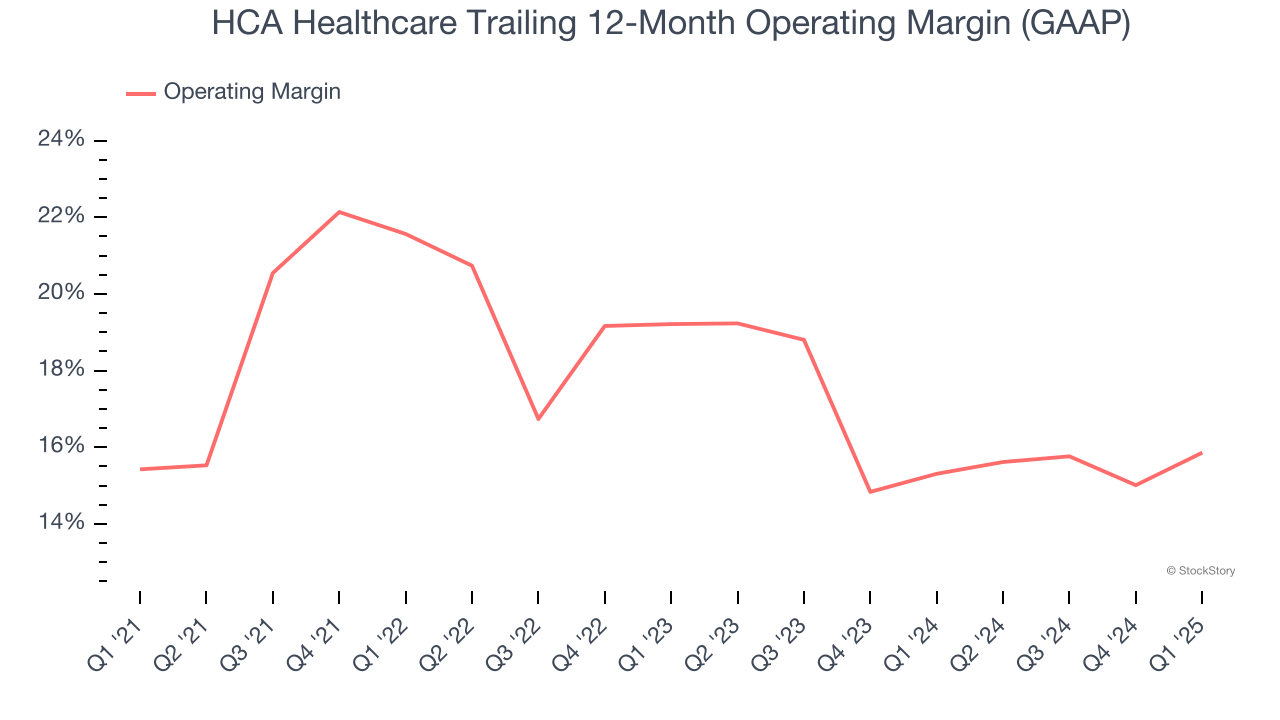

HCA Healthcare has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 17.4%.

Looking at the trend in its profitability, HCA Healthcare’s operating margin of 15.9% for the trailing 12 months may be around the same as five years ago, but it has decreased by 3.4 percentage points over the last two years. Still, we’re optimistic that HCA Healthcare can correct course and expand its profitability on a longer-term horizon due to its business quality.

This quarter, HCA Healthcare generated an operating profit margin of 20.3%, up 3.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

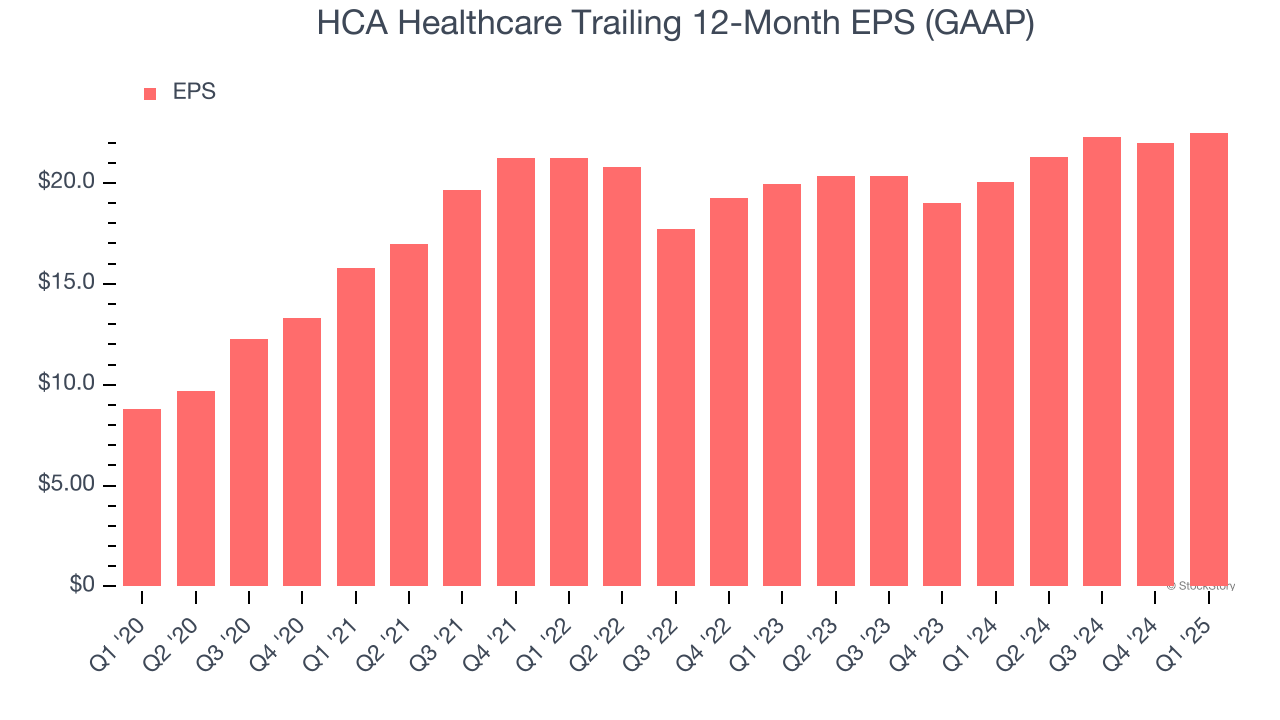

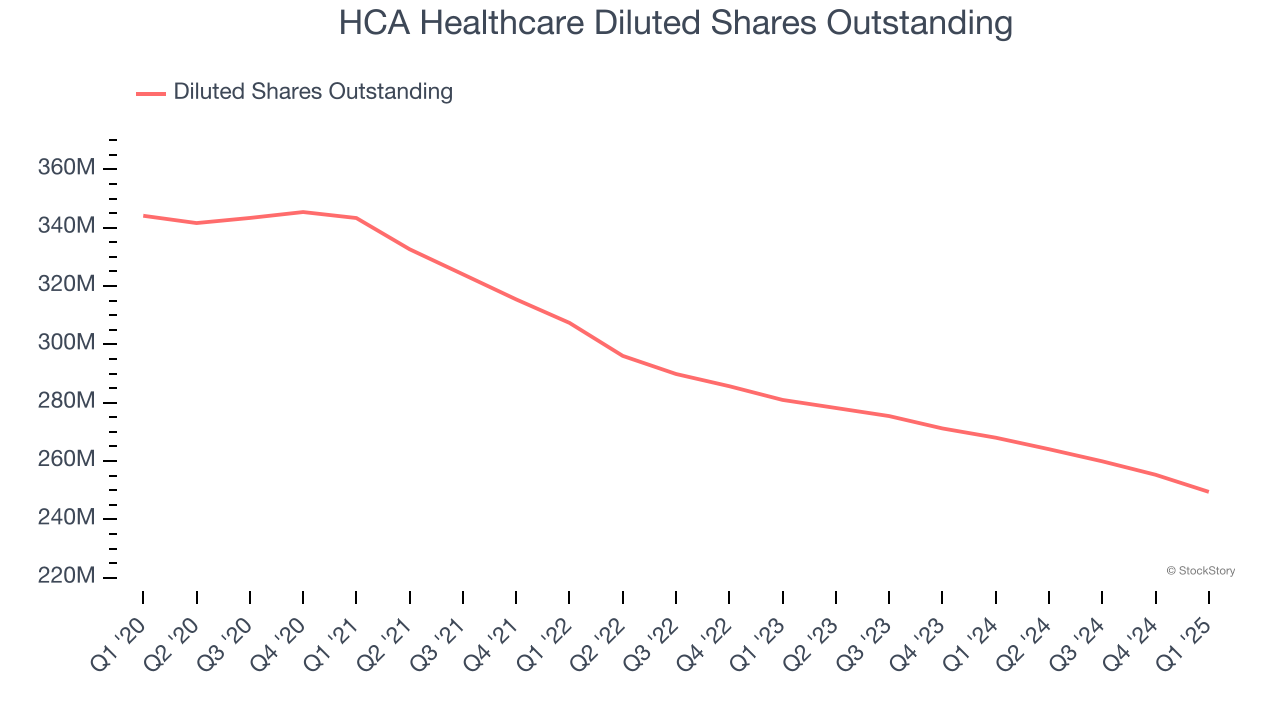

HCA Healthcare’s EPS grew at an astounding 20.7% compounded annual growth rate over the last five years, higher than its 6.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Diving into the nuances of HCA Healthcare’s earnings can give us a better understanding of its performance. A five-year view shows that HCA Healthcare has repurchased its stock, shrinking its share count by 27.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, HCA Healthcare reported EPS at $6.45, up from $5.93 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects HCA Healthcare’s full-year EPS of $22.50 to grow 14.9%.

Key Takeaways from HCA Healthcare’s Q1 Results

It was encouraging to see HCA Healthcare beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance was in line. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 1.4% to $346.39 immediately following the results.

So should you invest in HCA Healthcare right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.