Cable, internet, and telephone services provider Charter (NASDAQ:CHTR) met Wall Street’s revenue expectations in Q1 CY2025, but sales were flat year on year at $13.74 billion. Its GAAP profit of $8.42 per share was 0.6% above analysts’ consensus estimates.

Is now the time to buy Charter? Find out by accessing our full research report, it’s free.

Charter (CHTR) Q1 CY2025 Highlights:

- Revenue: $13.74 billion vs analyst estimates of $13.68 billion (flat year on year, in line)

- EPS (GAAP): $8.42 vs analyst estimates of $8.37 (0.6% beat)

- Adjusted EBITDA: $5.76 billion vs analyst estimates of $5.57 billion (42% margin, 3.5% beat)

- Operating Margin: 23.6%, in line with the same quarter last year

- Free Cash Flow Margin: 11.4%, up from 2.6% in the same quarter last year

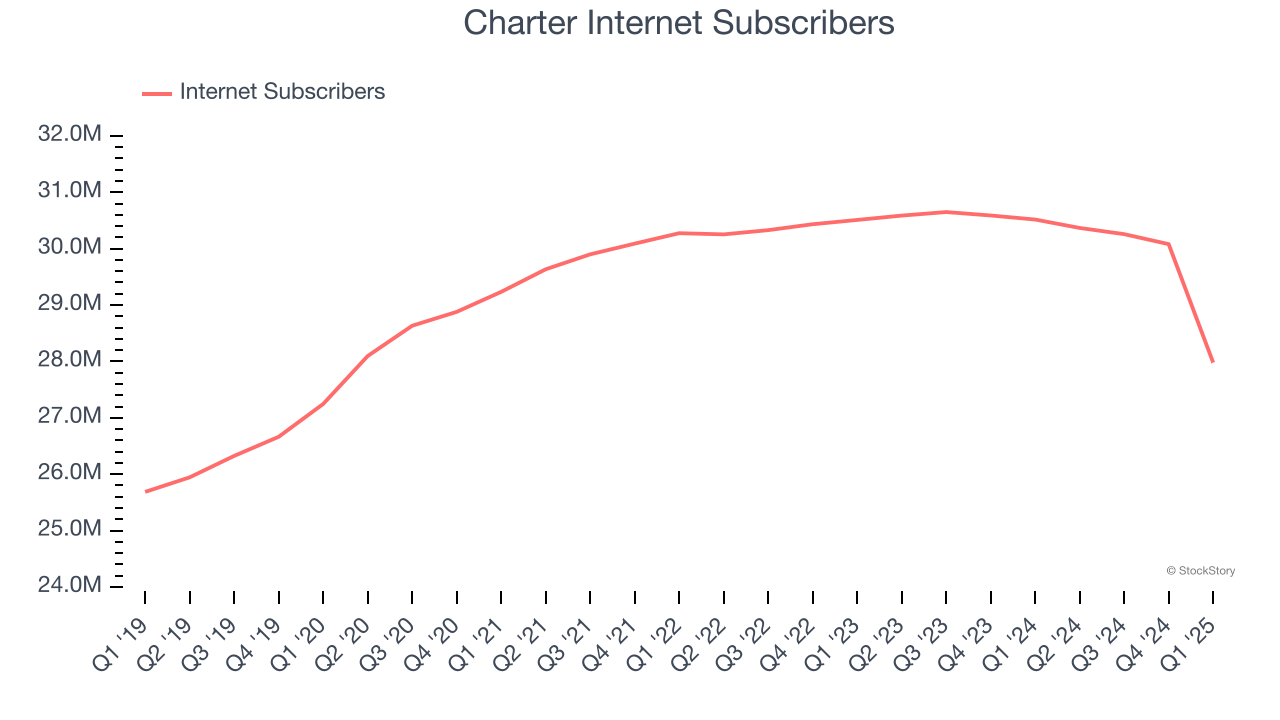

- Internet Subscribers: 27.98 million, down 2.54 million year on year

- Market Capitalization: $47.61 billion

"We continue to execute on our long-held strategy of delivering the best network and products, at the best value, combined with unmatched service," said Chris Winfrey, President and CEO of Charter.

Company Overview

Operating as Spectrum, Charter (NASDAQ:CHTR) is a leading telecommunications company offering cable television, high-speed internet, and voice services across the United States.

Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

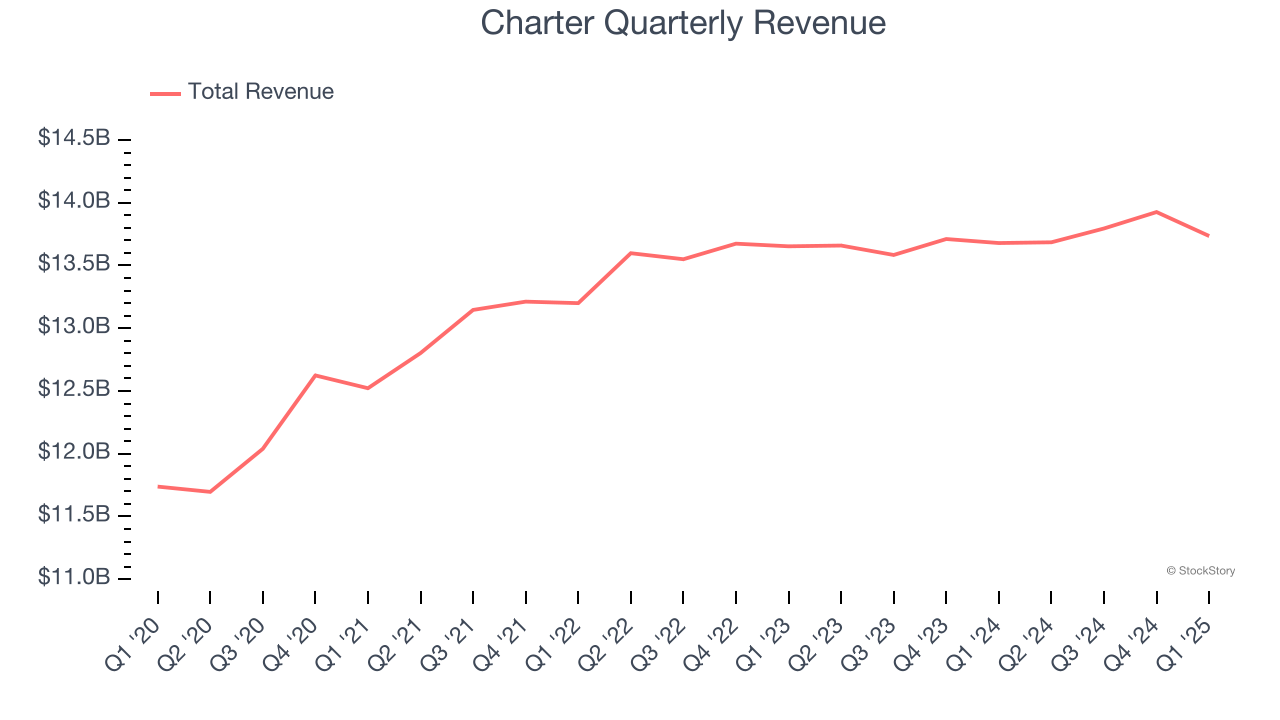

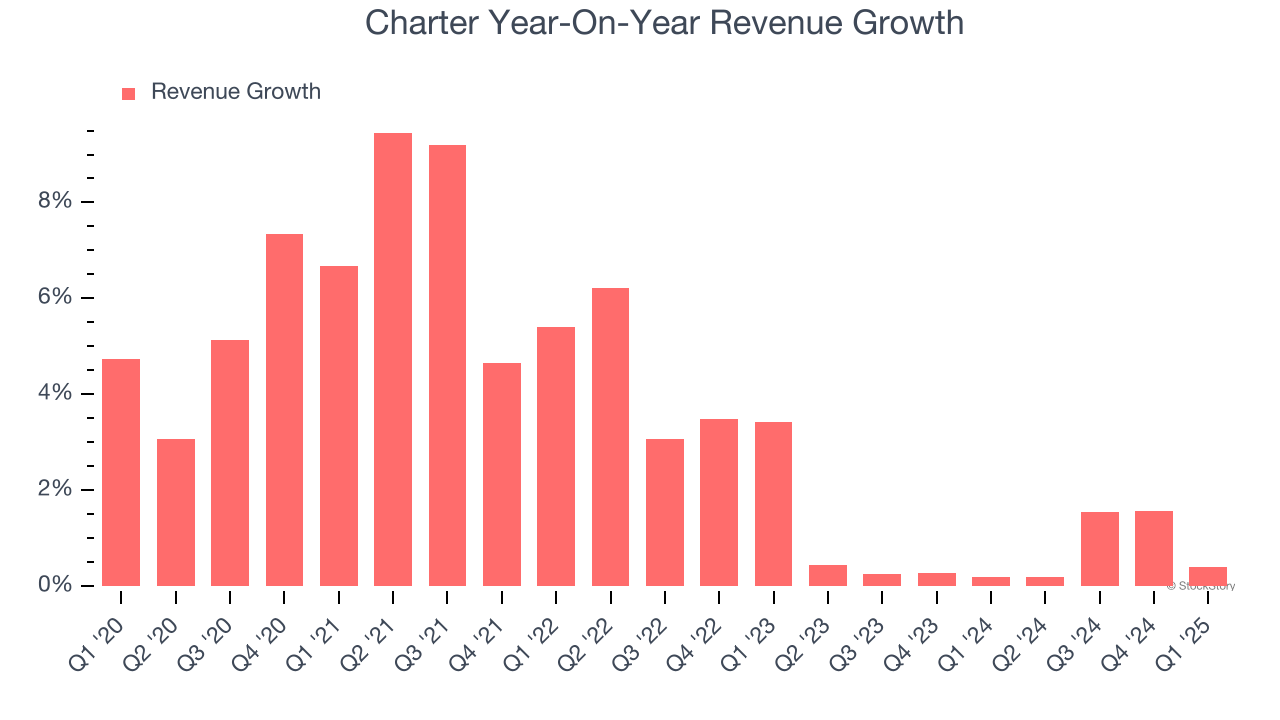

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Charter’s 3.6% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Charter’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can better understand the company’s revenue dynamics by analyzing its number of internet subscribers and video subscribers, which clocked in at 27.98 million and 12.16 million in the latest quarter. Over the last two years, Charter’s internet subscribers averaged 1.2% year-on-year declines while its video subscribers averaged 8.1% year-on-year declines.

This quarter, Charter’s $13.74 billion of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and implies its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

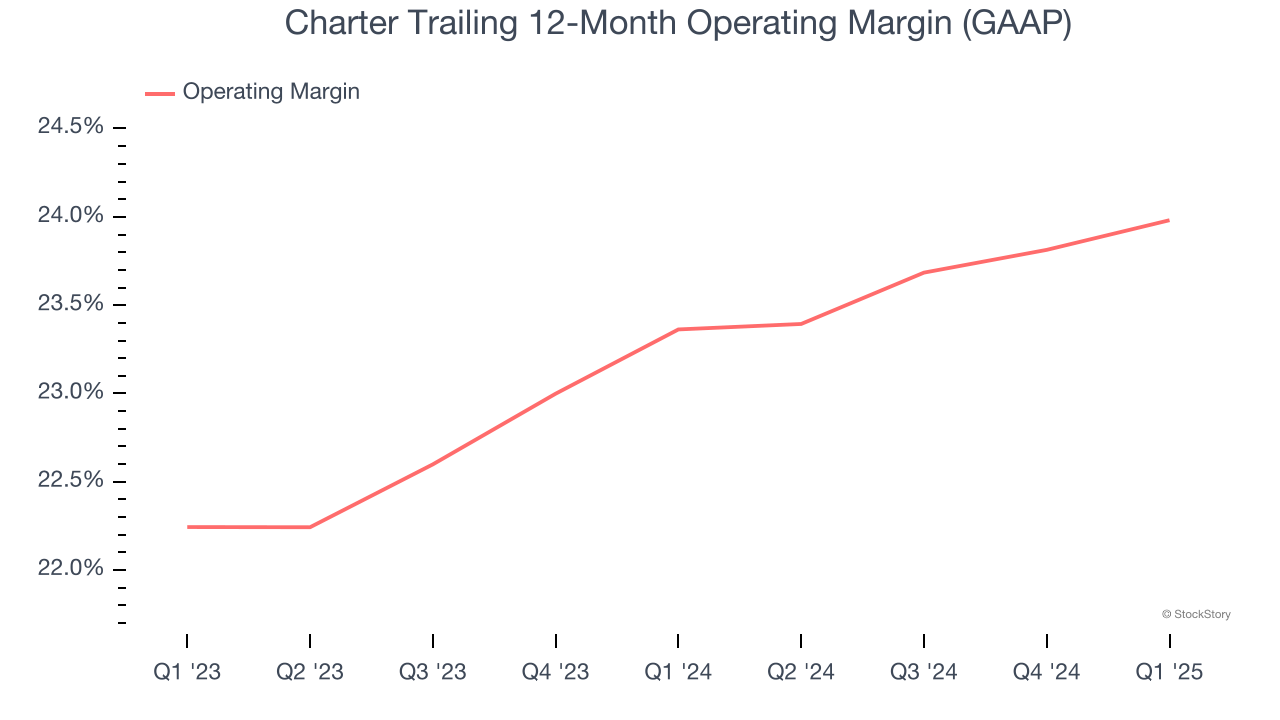

Operating Margin

Charter’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 23.7% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

This quarter, Charter generated an operating profit margin of 23.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

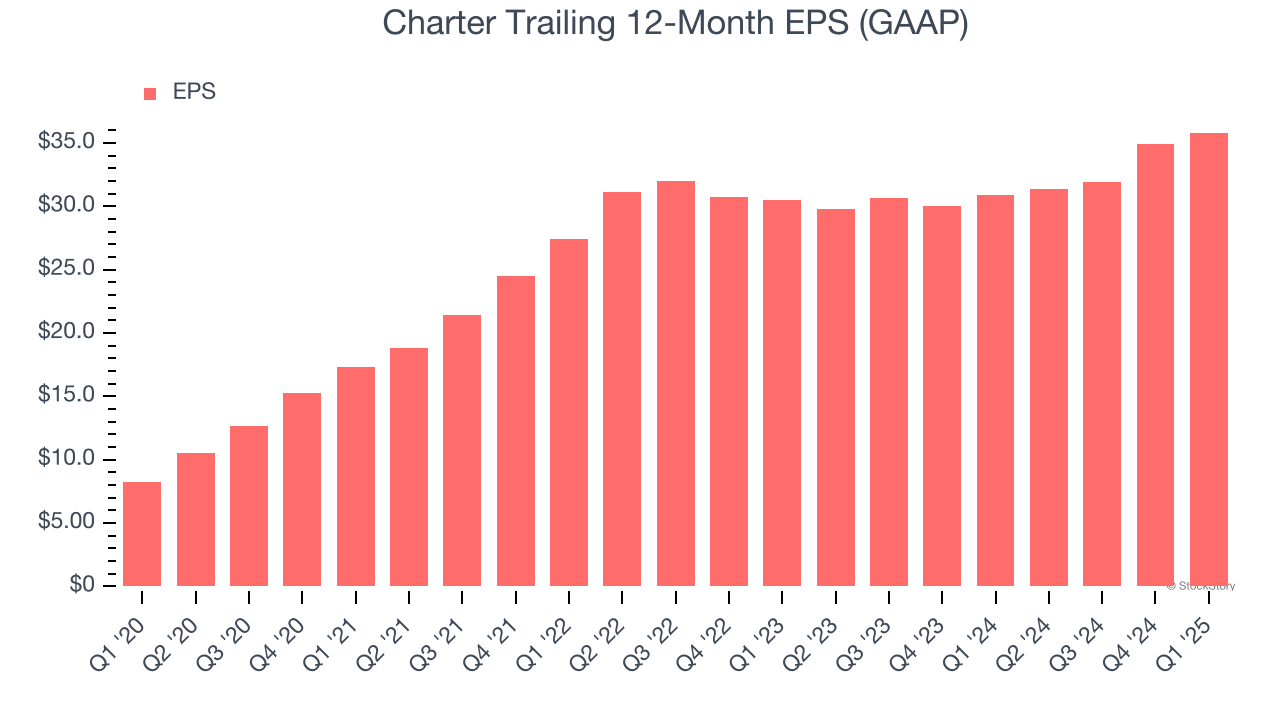

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Charter’s EPS grew at an astounding 34.1% compounded annual growth rate over the last five years, higher than its 3.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q1, Charter reported EPS at $8.42, up from $7.54 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Charter’s full-year EPS of $35.83 to grow 6.3%.

Key Takeaways from Charter’s Q1 Results

It was encouraging to see Charter beat analysts’ EBITDA and EPS expectations this quarter. There was also a nice year-on-year improvement in operating margin. On the other hand, its number of internet subscribers missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 3% to $344.99 immediately following the results.

Is Charter an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.