The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Matthews (NASDAQ:MATW) and the rest of the specialized consumer services stocks fared in Q2.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

While some specialized consumer services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.7% since the latest earnings results.

Best Q2: Matthews (NASDAQ:MATW)

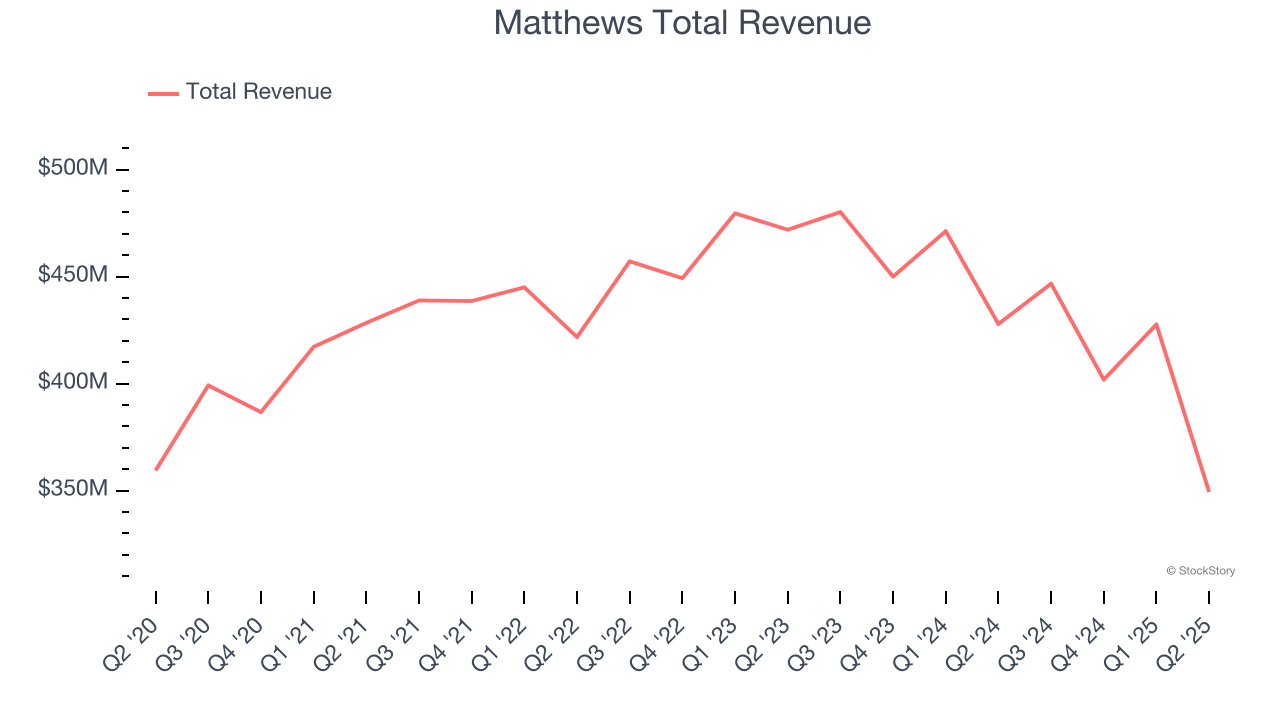

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $349.4 million, down 18.3% year on year. This print exceeded analysts’ expectations by 8.5%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS estimates and full-year EBITDA guidance beating analysts’ expectations.

Matthews pulled off the biggest analyst estimates beat but had the slowest revenue growth of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $24.28.

Is now the time to buy Matthews? Access our full analysis of the earnings results here, it’s free.

WeightWatchers (NASDAQ:WW)

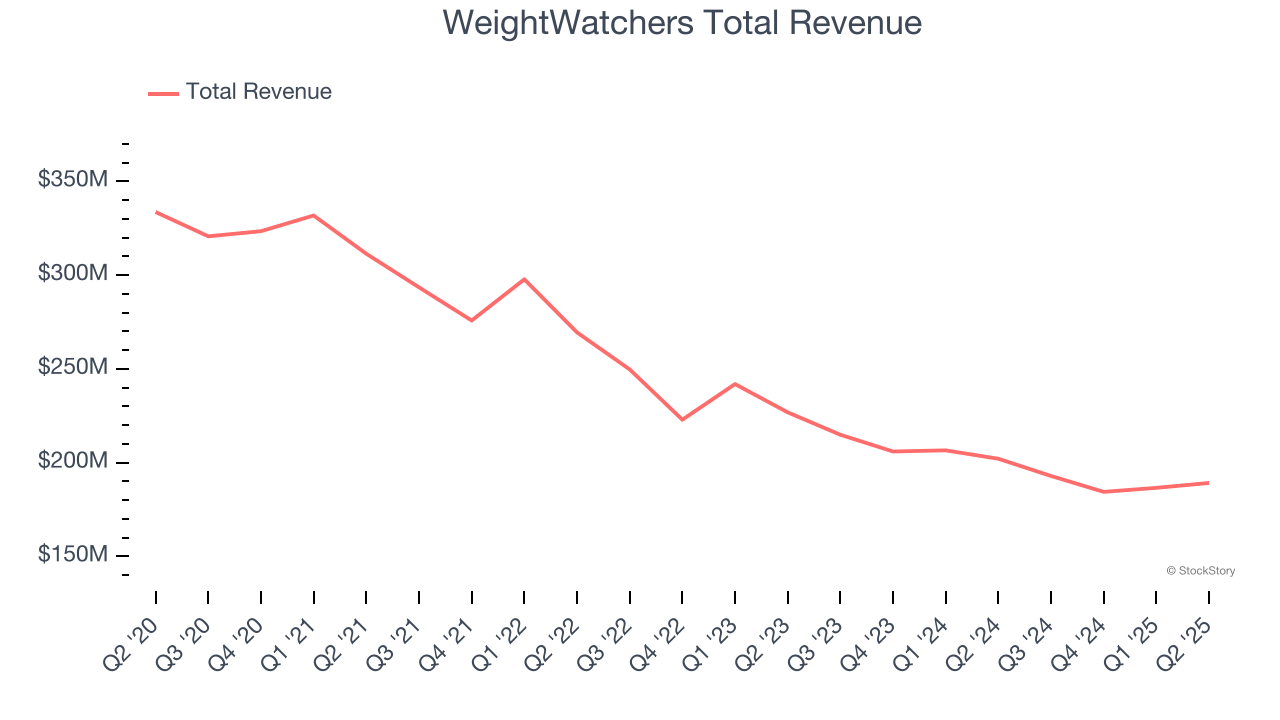

Known by many for its old cable television commercials, WeightWatchers (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WeightWatchers reported revenues of $189.2 million, down 6.4% year on year, outperforming analysts’ expectations by 6.2%. The business had a very strong quarter with a beat of analysts’ EPS and EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 29.1% since reporting. It currently trades at $27.01.

Is now the time to buy WeightWatchers? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: LKQ (NASDAQ:LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ:LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.64 billion, down 1.9% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 20.5% since the results and currently trades at $30.70.

Read our full analysis of LKQ’s results here.

Carriage Services (NYSE:CSV)

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

Carriage Services reported revenues of $102.1 million, flat year on year. This result topped analysts’ expectations by 0.8%. It was a strong quarter as it also logged full-year revenue guidance beating analysts’ expectations and a decent beat of analysts’ EBITDA estimates.

Carriage Services pulled off the highest full-year guidance raise among its peers. The stock is down 3.7% since reporting and currently trades at $44.54.

Read our full, actionable report on Carriage Services here, it’s free.

Pool (NASDAQ:POOL)

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ:POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Pool reported revenues of $1.78 billion, flat year on year. This number met analysts’ expectations. Taking a step back, it was a mixed quarter as it failed to impress in some other areas of the business.

The stock is down 2.1% since reporting and currently trades at $310.07.

Read our full, actionable report on Pool here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.