California-based Apple Inc. (AAPL) is a global tech powerhouse, dominating consumer electronics, software, and digital services with its iconic iPhones, Macs, iPads, Apple Watches, and a booming ecosystem of services. With a market cap of $4 trillion, unmatched brand loyalty, and record-setting revenues, Apple continues to define innovation and set the pace for the global tech industry.

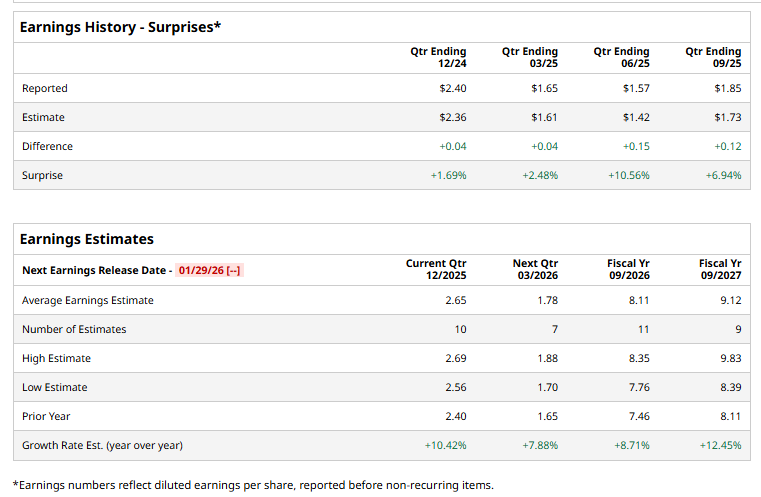

The tech behemoth is expected to announce its first-quarter results in the near future. Ahead of the event, analysts expect Apple to report a profit of $2.65 per share, up 10.4% from $2.40 per share reported in the year-ago quarter. The company has a solid earnings surprise history, surpassing the Street’s bottom-line projections in each of the past four quarters.

For FY 2026, AAPL is expected to deliver an EPS of $8.11, up 8.7% from $7.46 reported in 2025.

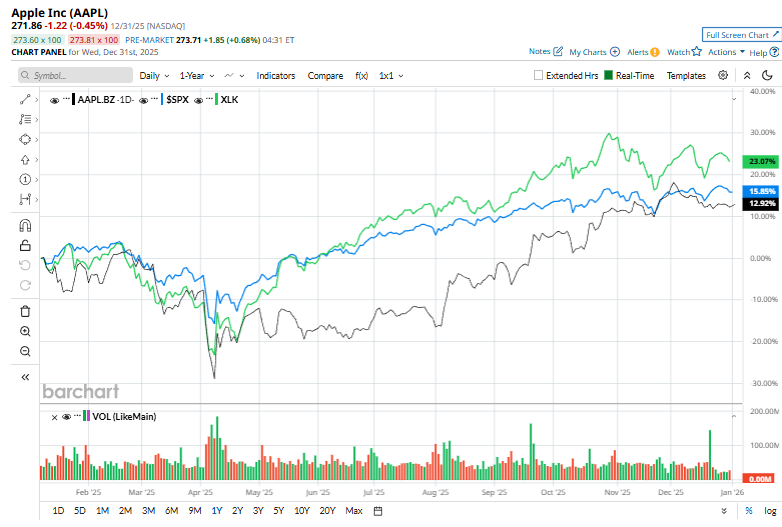

AAPL stock prices have gained 7.8% over the past 52 weeks, notably lagging behind the S&P 500 Index’s ($SPX) 16.4% gains and Technology Select Sector SPDR Fund’s (XLK) 22.8% surge during the same time frame.

After a lukewarm reception for the iPhone 16, Apple is poised for a comeback with the iPhone 17. Counterpoint Research predicts that Apple will become the world’s largest smartphone seller in 2025, surpassing Samsung for the first time in 14 years, and maintain this lead for the next four years. IDC also expects record iPhone shipments this year, driven by strong demand for the iPhone 17 and factors similar to the iPhone 13 cycle, including AI-driven upgrades, device replacement demand, and limited competition from Huawei.

The consensus opinion on AAPL stock remains moderately optimistic, with an overall “Moderate Buy” rating. Out of the 40 analysts covering the stock, 21 recommend “Strong Buys,” three advise “Moderate Buys,” 14 suggest “Holds,” one gives “Moderate Sell,” and one advocates a “Strong Sell” rating. Apple’s mean price target of $290.85 indicates a premium of 7% from the prevailing price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stock Index Futures Climb in Strong Start to 2026

- FTAI Aviation Is Getting into the Data Center Game. Should You Buy FTAI Stock Here?

- CrowdStrike Insiders Are Offloading CRWD Stock. Should You?

- After Record Runs for Western Digital and Sandisk in 2025, Consider This 1 Data Center Storage Stock for 2026