Restaurant stock Cava Group (CAVA) has underperformed dramatically this year, down 60% year-to-date as the major market benchmarks have set new record highs. CAVA’s stock price is down more than 28% over the past month alone, pressured by fears that a consumer crunch will leave the $15 salad store out in the cold. Are you buying this dip – or betting on more losses?

CAVA Stock: Set to Fall Another 10 Points?

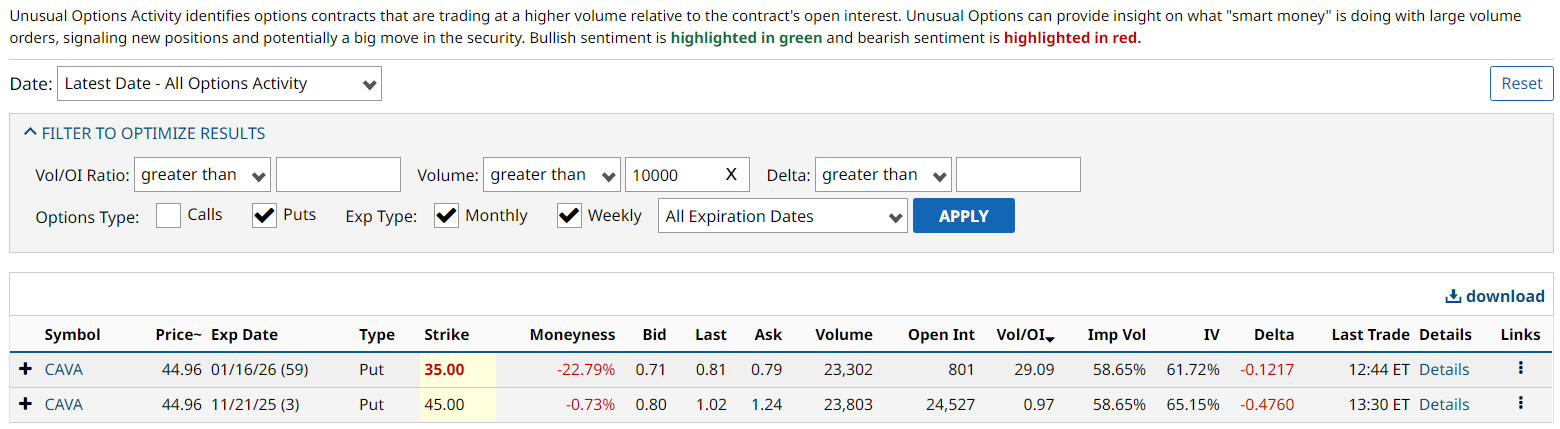

Based on the latest block trades, smart money is expecting additional downside for CAVA in the months ahead. Today, there was big unusual option activity at CAVA’s January 2026 35-strike puts, as volume of over 23,000 contracts hit the tape.

With a bearish slant to this volume, that implies expectations for roughly another 10-point, or 20%, drop between today and January:

CAVA Bear Could Be Rolling Puts Out & Down

This heavy January-dated put volume looks like a roll down from a long put position that’s set to expire at the end of this week.

The CAVA November 21 $45 puts are right at the money as of this writing, and you'll notice that similarly sized volume to the previous open interest position trades at this strike (with a neutral sentiment reading) at roughly the same time that new positions are being opened at the lower strike out in January:

As a result of today’s heavy options activity, CAVA’s put/call volume ratio spiked to 4.33 – blowing past the previous high set in October.

– John Rowland, CMT, is Barchart’s Senior Market Strategist and host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Consumer Stock is Already in a Bear Market. Smart Money Sees 20% More Downside Ahead.

- Data Science Points to Upside for Citigroup (C) Stock Despite the ‘Insurance’ Bet

- Domino's Pizza Stock is Undervalued Here - Shorting One-Month Put Options Yields 1.67%

- Are These Beaten-Down Bottom 100 Stocks to Buy Ready to Rebound?