With a market cap of $9.3 billion, Oklahoma-based Paycom Software, Inc. (PAYC) is a prominent cloud-based human capital management (HCM) and payroll software provider that serves businesses of all sizes across the U.S. Its platform offers an end-to-end suite of HR solutions, including payroll, time and attendance, talent management, benefits, and employee self-service, built on a single database to streamline workflows and reduce administrative complexity.

Shares of the software company have struggled to keep up with the broader market over the past 52 weeks. PAYC stock has declined 26.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.2%. Moreover, shares of Paycom Software are down 19% on a YTD basis, compared to SPX’s 14.5% gain.

Focusing more closely, shares of PAYC have also outpaced the Industrial Select Sector SPDR Fund’s (XLI) 8.7% return over the past 52 weeks and 15.4% in 2025.

On Nov. 11, Paycom shares climbed 2.1% after the company reported its third-quarter results, which showed solid top-line momentum despite ongoing macro pressures. The company posted revenue of $493.3 million, up 9.1% year over year, supported by steady client additions and strong demand for its HR and payroll automation platform. While earnings were slightly softer, with adjusted EPS of $1.94 missing estimates by a small margin due to higher operating expenses, overall profitability remained healthy. Paycom expects full-year 2025 revenue to fall between $2.05 billion and $2.06 billion, implying roughly 9% year-over-year growth at the midpoint of its outlook.

For the fiscal year ending in December 2025, analysts expect PAYC’s EPS to decrease 12.1% year-over-year to $7.58. However, the company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters.

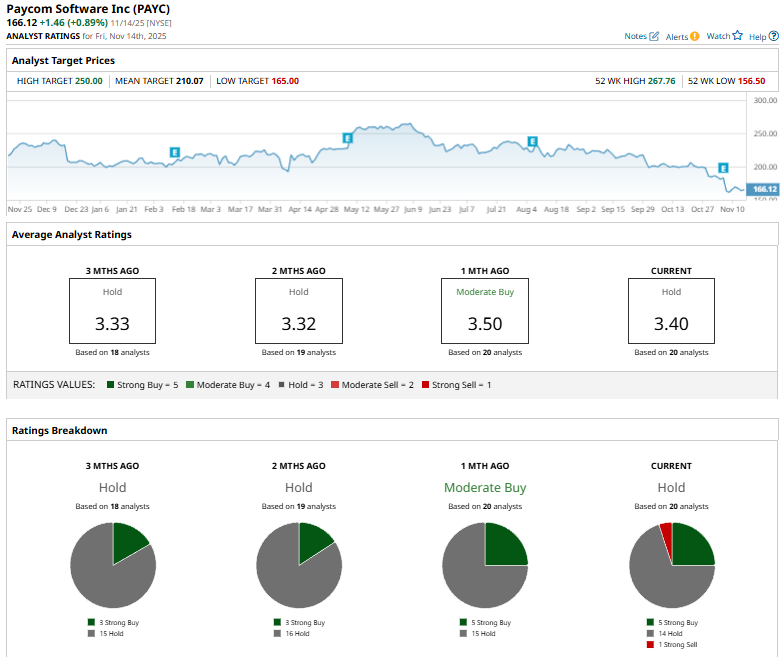

Among the 20 analysts covering the stock, the consensus rating is a “Hold.” That’s based on five “Strong Buy” ratings, 14 “Holds,” and one “Strong Sell.”

The current consensus is bearish than a month ago when the stock had an overall “Moderate Buy” rating.

On Oct. 15, Citi analyst Steve Enders reiterated his “Hold” rating on Paycom and kept the price target at $228.

The mean price target of $210.07 represents a 26.5% premium to PAYC’s current price levels. The Street-high price target of $250 suggests a nearly 50.5% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart