Dover Corporation (DOV) is a diversified global industrial manufacturer headquartered in Downers Grove, Illinois. With a market cap of around $25.1 billion, Dover operates across five major segments: Engineered Products, Clean Energy & Fueling, Imaging & Identification, Pumps & Process Solutions, and Climate & Sustainability Technologies, offering equipment, consumables, software, and services for customers in markets including aerospace, industrial, fueling, refrigeration, and more.

Dover has significantly lagged behind the broader market. Over the past year, DOV stock has declined 9.4% and slipped 2.4% on a year-to-date (YTD) basis, compared to the S&P 500 Index’s ($SPX) 13.2% gains over the past year and 14.5% returns in 2025.

Narrowing the focus, DOV has also underperformed the sector-focused Industrial Select Sector SPDR Fund’s (XLI) 8.7% surge over the past year and 15.4% gains in 2025.

Dover stock has slipped in 2025 because, despite cost-cutting and modest bookings strength, its core revenue growth is weaker than expected, and demand in key capital-goods businesses is soft. Added to that, analysts point to stagnating organic growth that can limit upside as a long-term concern.

For the full fiscal 2025, ending in December 2025, analysts expect DOV to report an EPS of $9.59, up 15.7% year-over-year. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

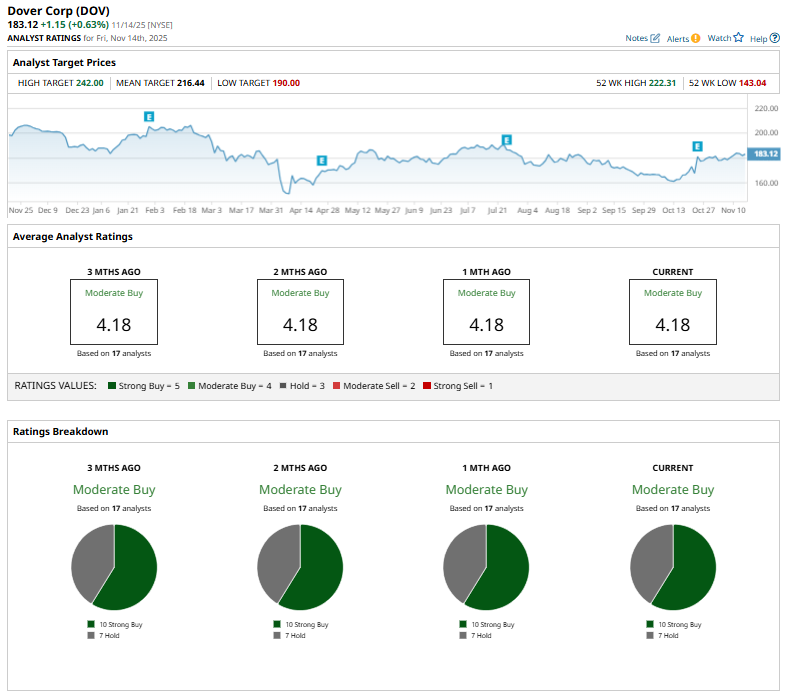

The stock has a consensus “Moderate Buy” rating overall. Of the 17 analysts covering the stock, opinions include 10 “Strong Buys” and seven “Holds.”

This configuration has remained largely consistent over the past few months.

Last month, RBC Capital raised its price target on Dover to $198 from $183, while keeping a “Sector Perform” rating.

DOV’s mean price target of $216.44 represents an 18.2% premium to current price levels. Meanwhile, the street-high target of $242 suggests a 32.2% upside potential.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart