With a market cap of $69.8 billion, TE Connectivity plc (TEL) is a global leader in connectors, sensors, and electronic components used across high-growth industries. The Ireland-based company designs and manufactures highly engineered solutions that enable power, signal, and data flow in applications ranging from automotive and EVs to aerospace, industrial equipment, communications, and medical devices.

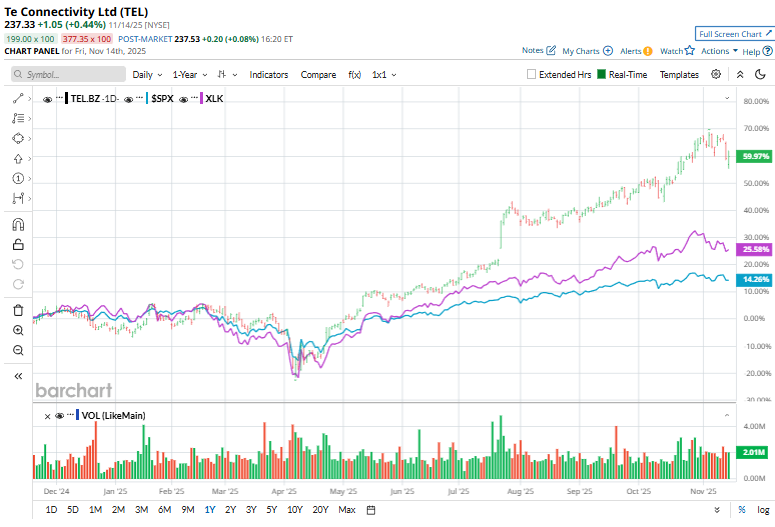

Shares of the company have outpaced the broader market over the past 52 weeks. TEL stock has increased 54.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.2%. Moreover, the stock is up nearly 66% on a YTD basis, compared to SPX's 14.5% gain.

In addition, shares of the electronics maker have outperformed the Technology Select Sector SPDR Fund's (XLK) 22.9% return over the past 52 weeks and 23.9% in 2025.

TE Connectivity delivered its fourth-quarter earnings on Oct. 29, and its shares rose 1.8%. The company posted $4.75 billion in revenue, up 17% year over year, with 11% organic growth, reflecting broad-based strength across its transportation and industrial segments. Its adjusted EPS reached a record $2.44, up 25% from the prior year. Orders were another highlight, rising 22% to $4.7 billion, indicating continued momentum in demand. TE Connectivity also delivered exceptional cash generation, producing $1.4 billion in operating cash flow and a record $1.2 billion in free cash flow, which enabled the company to return approximately $650 million to shareholders during the quarter.

For the fiscal year ending in September 2026, analysts expect TEL's adjusted EPS to grow 16.6% year-over-year to $10.21. The company's earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

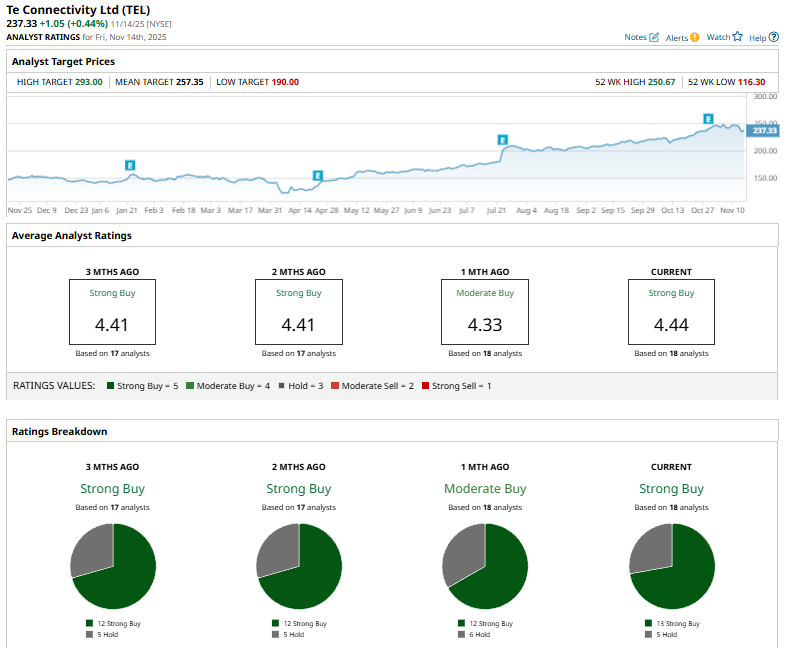

Among the 18 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 13 “Strong Buy” ratings and five “Holds.”

This configuration is more bullish than a month ago, with 12 “Strong Buy” ratings on the stock.

On Nov. 4, Barclays analyst Guy Hardwick reiterated his “Overweight” rating on TE Connectivity and raised the price target to $277 from $249, reflecting an 11.24% increase and signaling sustained confidence in the company’s outlook.

The mean price target of $257.35 represents an 8.4% premium to TEL’s current price levels. The Street-high price target of $293 suggests a 23.5% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart